I have an IRA I keep maxed out and managed by someone else but more as a hobby I thought i would learn how to invest so I started watching Youtube videos and reading mrmoneymostache and the first thing I learnt is I may be getting ripped off as they charge me 1.35% to manage my IRA.

What advice would you give someone new to investing that wanted to learn more about the process? I just moved 10 grand to a Vanguard account and plan to open up a total market index fund with that but I would also love to learn how to pick some of my own stocks. I am self employed, own some real estate so I really don't mind some risk and once I have a better hang of things I may roll over my IRA into Vanguard.

You absolutely are getting ripped off getting charged 1.35%, unless your friend is Warren Buffet and consistently beating the market by 2%. A completely set-and-forget robo-investor can do it for .25-.35%.

The Bogleheads wiki has a lot of great stuff, although their asset allocation is very conservative, especially if you're young (I personally run ~90% stock/commodity and 10% bond).

There are a variety of strategies in regards to stock picking;

The Intelligent Investor is considered to be the definitive classic on what is called value investing (finding companies that are considered undervalued by the market), and one of the books that Buffett got rich off of.

If you want to pick your own stocks, Fidelity and Schwab are both good. So is Merrill Edge if you have a large asset pool, because Bank of America rewards their customers based on how much money you have with them (free trades if you have more than $50k with them as well as credit card bonuses).

Vanguard is good as far as 401ks, and they are considered to be one of the best families for passively-managed funds, but they are not a good pick if you are looking to frequently buy and sell stock, because they charge $20? $25? a trade.

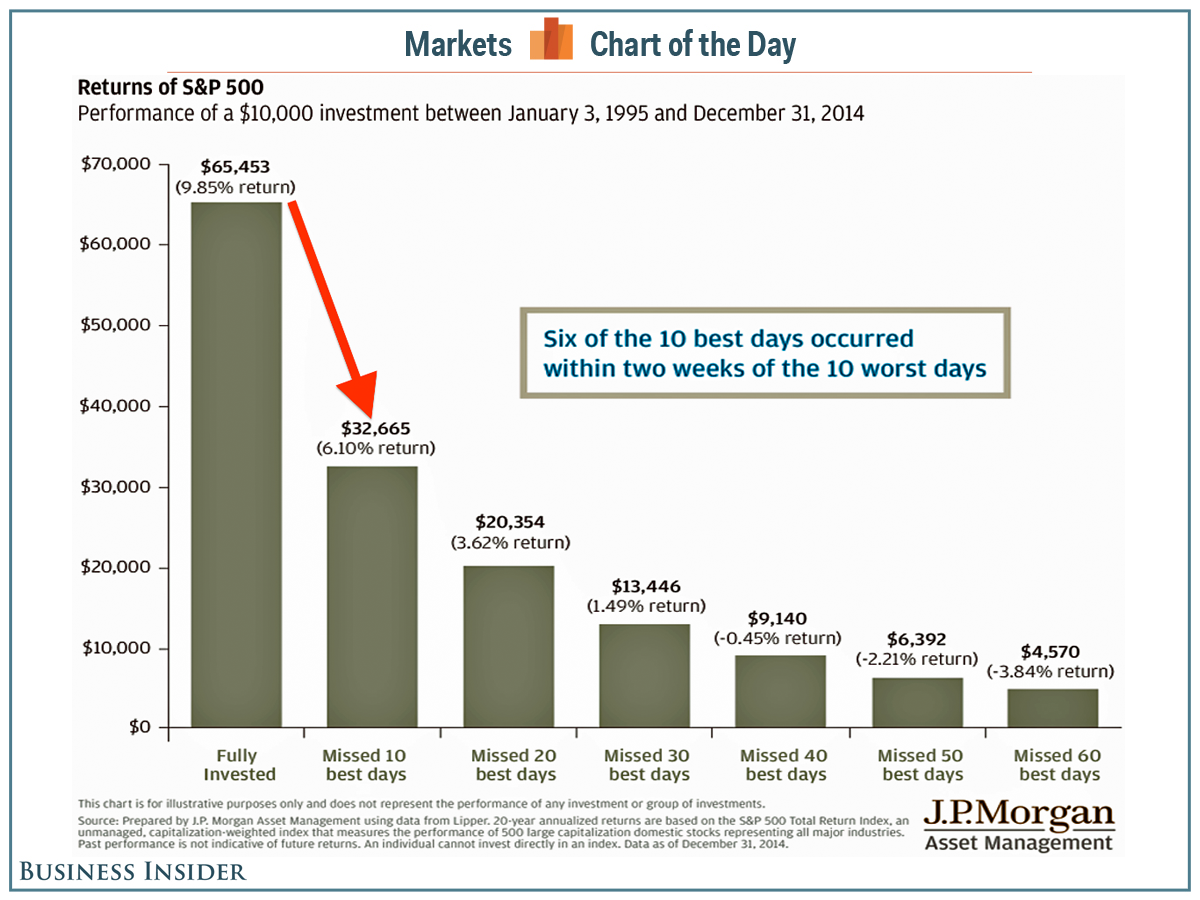

Beware of fees. They are what kills your return more than anything else. Market jitters are an inevitability, fees can be minimized.