Estate Planning

- Thread starter Harfle

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

With a lawyer. Only other option if your situation is very straightforward is legal zoom. Financial advice here is hard enough with so many variables, estate planning is a whole other ball of wax . Again depending on how complex you can spend $1000 on a lawyer and put together a decent plan. If you need trusts to be formed may pay more. Read dummy books just to familiarize yourself before calling people.

Vaclav

Bronze Baronet of the Realm

- 12,650

- 877

Well even before talking to anyone, is figure out how big you're planning your family to be - who will be involved in getting benefit from your estate and the minimum duration that you want the estate to run.

There's a world of difference between setting up a trust to last generations for a huge family and setting one up for two kids and that's it for example. (i.e. in my case - only taking care of my niece and nephew, rest will go to charity)

There's a world of difference between setting up a trust to last generations for a huge family and setting one up for two kids and that's it for example. (i.e. in my case - only taking care of my niece and nephew, rest will go to charity)

Tortfeasor

Molten Core Raider

- 1,014

- 199

I'm a lawyer and I do estate planning. What exactly are trying to achieve with regard to your stuff for when you die? Do you have more than $5 million in net worth and are thus contemplating federal estate tax? You'll have to be more specific if you want useful internet advice, but the best thing I can recommend to everyone is to learn exactly what happens during the probate process in your state. Most estate planning is geared toward contingencies occuring within that process or taking measures to bypass that process entirely.

Izo

Tranny Chaser

- 20,549

- 26,551

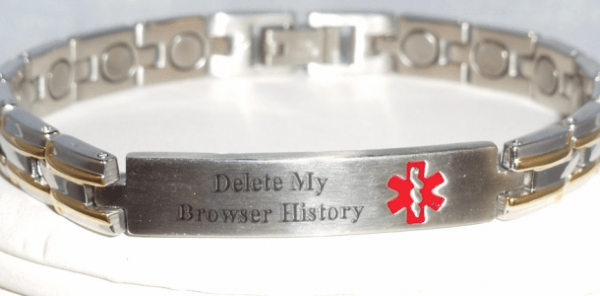

I just want to know how to ensure that my PC hard drive is erased upon my death.

Tortfeasor

Molten Core Raider

- 1,014

- 199

This is myopic, awful advice. There are plenty of ways to screw up a will but even if you don't, a will is simply a really fancy letter to the probate judge asking "pretty please make x,y,z happen. please." A will still has to be probated with your estate and that process can go for months or years (thereby preventing your heirs from getting their inheritance for months or years) and will cost alot of money. Estate planning is not just writing a will.If your estate is below the threshold for the federal estate tax then there's nothing to plan, really. Have a will made if you want specific things to happen or your property to devolve in a manner different from your state's default rule.

My bad bro, I forgot how awful the common law is. Here, under the civil law, a succession is an easy matter with or without a will, over and done with in a matter of days for 99% of people.This is myopic, awful advice. There are plenty of ways to screw up a will but even if you don't, a will is simply a really fancy letter to the probate judge asking "pretty please make x,y,z happen. please." A will still has to be probated with your estate and that process can go for months or years (thereby preventing your heirs from getting their inheritance for months or years) and will cost alot of money. Estate planning is not just writing a will.

But let's be honest: even under the common law the estates of the vast majority of people resolve quickly, sending the heirs or legatees into possession. Your job, as an estate planner, is to help the very rich reduce taxes or to help people do something (disinherit a spouse or child) that they wouldn't normally be able to do under the default rule. Only the 1% need an estate to be planned.

Considering how retarded Harfle's posts are I doubt she has all that much estate to plan.

Harfle

Lord Nagafen Raider

- 1,055

- 69

Glad you know me well bro, Anyways I am about halfway to federal estate tax. Just want to make sure I get things in order.Considering how retarded Harfle's posts are I doubt she has all that much estate to plan.

Harfle

Lord Nagafen Raider

- 1,055

- 69

Yeah kin do of want to prevent having that happen again. I had to go through it took almost 2 years before anyone got anything.This is myopic, awful advice. There are plenty of ways to screw up a will but even if you don't, a will is simply a really fancy letter to the probate judge asking "pretty please make x,y,z happen. please." A will still has to be probated with your estate and that process can go for months or years (thereby preventing your heirs from getting their inheritance for months or years) and will cost alot of money. Estate planning is not just writing a will.

Tortfeasor

Molten Core Raider

- 1,014

- 199

If you dont have any tax issues I you probably just want to go get a revocable trust done. That will keep your estate from getting tied up and make the transition much easier/cheaper/better.

Share: