Home buying thread

- Thread starter Pasteton

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Not insane at all. This is how it works.Parents listed their home in Houston 4 weeks ago, 1 in person viewing, no offers

Friend in Austin (cedar park) listed 3 weeks ago, 1 viewing

Both well under comps. The rate that the floor has dropped is insane

Fogel

Mr. Poopybutthole

Parents listed their home in Houston 4 weeks ago, 1 in person viewing, no offers

Friend in Austin (cedar park) listed 3 weeks ago, 1 viewing

Both well under comps. The rate that the floor has dropped is insane

Prices take the staircase up and the elevator down

- 1

It makes sense since 2 months ago the market still had a huge number of people with preapprovals at lower rates and you had that last frenzy of bidding, now probably 10 people of that dozen who didn't get a house are on the sidelines since everyone has been talking up a real estate crash, but they still want a house, they still want a house in that area and for the most part they still have the job that lets them afford their original losing bid. Even if you figure they lost the bid by 10% and interest rates increase cost them another 20% of what they can afford in terms of home price that is still a lot of pent of demand.Just 2 months ago, every home in the Austin area was getting a dozen of OFFERS after the first weekend. I'm curious how the next home sales volume report will look compared to 08

For those reasons, I still think the real estate correction will be minimal and anyone on the side lines hoping for more than a 10% drop will be disappointed. Supply is still a major issue, and new home starts falling means it won't be getting better so it is just hard to envision a huge correction like 08 unless something else major happens in the economy.

Now if the fed fails in correcting inflation and high inflation persists and we end up here a year from now with them not cutting rates then I think the market starts to correct more sharply because a lot of the buying now is based on people assuming they can refinance in a year or two I think. Real estate is always a slow burn.

The correction wont be minimal mainly because of the stupidity in the market from the speculative seller perspective. Fuck 'em.It makes sense since 2 months ago the market still had a huge number of people with preapprovals at lower rates and you had that last frenzy of bidding, now probably 10 people of that dozen who didn't get a house are on the sidelines since everyone has been talking up a real estate crash, but they still want a house, they still want a house in that area and for the most part they still have the job that lets them afford their original losing bid. Even if you figure they lost the bid by 10% and interest rates increase cost them another 20% of what they can afford in terms of home price that is still a lot of pent of demand.

For those reasons, I still think the real estate correction will be minimal and anyone on the side lines hoping for more than a 10% drop will be disappointed. Supply is still a major issue, and new home starts falling means it won't be getting better so it is just hard to envision a huge correction like 08 unless something else major happens in the economy.

Now if the fed fails in correcting inflation and high inflation persists and we end up here a year from now with them not cutting rates then I think the market starts to correct more sharply because a lot of the buying now is based on people assuming they can refinance in a year or two I think. Real estate is always a slow burn.

- 1

It's hard to say without seeing the actual listings from both those times. Outside of a few really insane markets going from 213k to 499k probably means an extensive renovation.The correction wont be minimal mainly because of the stupidity in the market from the speculative seller perspective. Fuck 'em.

View attachment 424085

View attachment 424086

View attachment 424087

View attachment 424088

View attachment 424089

It's also very local, so if the labor market weakens and company start cutting the work from home back significantly alot of these vacation markets that really boomed will crash hard. A lot of those areas are probably places with no industry and no good jobs that all of a sudden had good jobs because of work from home, I don't know a single manager who isn't getting tired of WFH fast though. But I don't think Austin falls into that bucket.

None of that is a price decline that is just asking prices meaning maybe the price growth will slow, THERE IS NO SUPPLY for the 50th time. You guys have made this thread unreadable with this nonsense for so long now. Go back and look over a year ago of the impending doom when people would have to start paying their mortgages that not only didnt materialize prices went up. THe same posters dont question how they were so wrong instead just double down on it.The correction wont be minimal mainly because of the stupidity in the market from the speculative seller perspective. Fuck 'em.

View attachment 424085

View attachment 424086

View attachment 424087

View attachment 424088

View attachment 424089

We are at near record levels of equity in homes, and you chucklefish keep talking about a RE crash. New Home starts are falling off a cliff but somehow even less supply is going to make the prices go down and millennials have just begun establishing new households. Must work for the Whitehouse economic team.

Yet if I asked any of the people saying this, "do you think the dollar is being de valued?" the response would be an overwhelming yes but somehow you then think the most critical hard assets valued against that currency are going to crash. Please make it make sense. This is nothing but missing out angst. People are pissed at RE prices so logically they must crash, hiding the fact all the people saying that are salivating at the chance to BUY and are upset the prices have got away from them.

I don't believe we have any substantive YoY decline in the avg national home price (>5%) and it won't surprise me if we don't get any at all. Even if it were to drop 5% from here it would still be up on the year. It sucks I know, but people really need to stop forming opinions on their feels and what they want the situation to be. Assets that crash are assets that nobody freaking wants at any price. The fact you want them to decline is why they wont.

This is not crypto or some no profit tech company. I don't go buy fagcoin just because it drops 70% because I don't give a shit about fagcoin and it has no tangible value . People are desperate for housing and we are the lowest levels of supply that we have ever seen in our lives. Do the math. What's more likely to happen is even less activity if that is possible. Meaning crazy low level of transactions. This problem doesn't go away until we find away to get a lot more houses on the market.

Affordability will always keep some lid on prices people may be desperate for a home but they still can only afford what they can afford. The net result is no sales, nobody builds anything, nobody moves. It's just a giant pent up demand for any unit that become available that the best off buyers can afford. We under built for over a decade after GFC .

Look at this chart. Realize we aren't even at 1970s level of production of housing units with a much larger population, and then everyone can start making posts that make a modicum of sense. We aren't even producing at replacement+pop growth rate and housing starts are in bad decline right now.

Some of these parts of the country austin, denver, etc. found the affordability "limit" that is not a pending crash, the voracious buyers aren't gone. The moment becomes affordable they will be right back bidding away. For it to crash you must have aseller who MUST sell and no willing buyer, meanwhile people are sitting on super affordable low interest mortgages and a shit ton of equity.

- 7

Largely agree with what you said, I think the point on the amount of transactions is extremely relevant.This is not crypto or some no profit tech company. I don't go buy fagcoin just because it drops 70% because I don't give a shit about fagcoin and it has no tangible value . People are desperate for housing and we are the lowest levels of supply that we have ever seen in our lives. Do the math. What's more likely to happen is even less activity if that is possible. Meaning crazy low level of transactions. This problem doesn't go away until we find away to get a lot more houses on the market.

People need to realize the trend in the market now and the trend in rates is putting huge pressure on people to not move and to not sell their old house if they do move, because if you have a mortgage from the past few years at sub 3% you are at a negative real rate right now, but if you sell that's gone. It will put tons of pressure on people to just stay put or if they do move to rent the old place instead of sell.

- 1

- 1

Lanx

<Prior Amod>

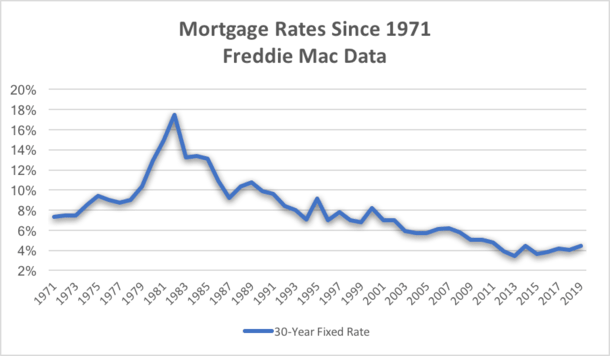

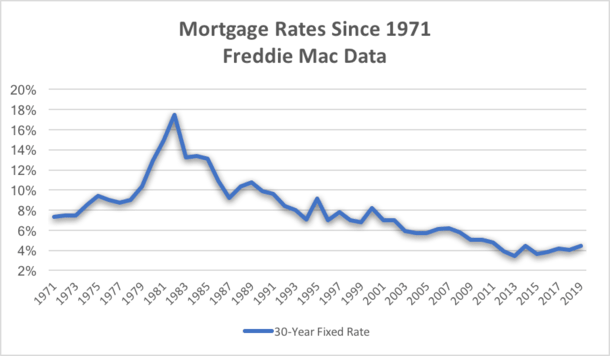

5% is still pretty good, if we look at our parents, they paid up the ass for a home in the 80sjudging by zillow, there's no longer a supply issue. rate of homes may still be below where they should be, but demand has fallen below supply. my guess is due to rates and the pending recession

it's just the super inflated values makes a mortgage w/ 5 or 6points hard to swallow for a middle class family

Why not just look it up and instead of speculating?judging by zillow, there's no longer a supply issue. rate of homes may still be below where they should be, but demand has fallen below supply. my guess is due to rates and the pending recession

Inventories are EXTREMELY low . Have they improved from the lowest number on record? Yup they have improved some last few months, outstripping demand??

- 1

I still see stuff selling in less than a month, which is historically good. It isn't getting bid up longer and in my local market stuff is even going a little under asking. But it isn't way under, it's not off a cliff by any means and the thing to remember with looking at Zillow price cuts is that price wasn't necessarily the market price ever.

If I take my home valued at 1.5M and list it for 1.7 and it doesn't sell and I cut the price 2 weeks later that isn't indicating the value of actual transactions coming down, it's just indicating a top, ya in April and early May you could take the last comparable, add 10% and list your home and it would sell 5% over even the inflated asking. You can't do that anymore but people still tried and I think by and large that's the stuff seeing price cuts.

If I take my home valued at 1.5M and list it for 1.7 and it doesn't sell and I cut the price 2 weeks later that isn't indicating the value of actual transactions coming down, it's just indicating a top, ya in April and early May you could take the last comparable, add 10% and list your home and it would sell 5% over even the inflated asking. You can't do that anymore but people still tried and I think by and large that's the stuff seeing price cuts.

- 1

Let's see 10% inflation and a 5% mortgage that is a negative -5% real rate, it's not just good its unimaginably good. People thinking 3% during 1.5% inflation is better than 5% with 10%. Can't make this shit up.5% is still pretty good, if we look at our parents, they paid up the ass for a home in the 80s

it's just the super inflated values makes a mortgage w/ 5 or 6points hard to swallow for a middle class family

5% is only bad if you think the inflation is transitory and the same lot saying how bad this shit is are the same ones thinking inflation isn't going away.

Lanx

<Prior Amod>

like i said, use realtor dot com w/ reduced pricing and you see huge swaths of reductions, the ppl who reduce are panicking or way over valued their homeI still see stuff selling in less than a month, which is historically good. It isn't getting bid up longer and in my local market stuff is even going a little under asking. But it isn't way under, it's not off a cliff by any means and the thing to remember with looking at Zillow price cuts is that price wasn't necessarily the market price ever.

If I take my home valued at 1.5M and list it for 1.7 and it doesn't sell and I cut the price 2 weeks later that isn't indicating the value of actual transactions coming down, it's just indicating a top, ya in April and early May you could take the last comparable, add 10% and list your home and it would sell 5% over even the inflated asking. You can't do that anymore but people still tried and I think by and large that's the stuff seeing price cuts.

There are always people in such a frothy environment who will push the limit to it's absolute maximum. When I just sold my realtor convinced me to raise another $10k higher than what I already thought was high. It went for another $10k even higher than that. Existing listings are the knife edge of pricing they can at times get quite exaggerated. We are seeing some of this behavior stop which is a great, but people forget prices have been steadily climbing since 2015 in most of the country and without the craziness that we saw this past winter.like i said, use realtor dot com w/ reduced pricing and you see huge swaths of reductions, the ppl who reduce are panicking or way over valued their home

Look at inventory levels for Jan 22 there was almost no homes for sale in the entire country compared to normal levels, and a result we saw things get silly. That condition is now cooling off, my pt has been that is not a recipe for a "crash" . The way things were was unsustainable. We may have no increase for the rest of the year into next spring.

People also forget that if inflation stays high, then housing prices that grow less than the rate of inflation is improving affordability/value even if the prices are still climbing.

<Wall of text>None of that is a price decline that is just asking prices meaning maybe the price growth will slow, THERE IS NO SUPPLY for the 50th time. You guys have made this thread unreadable with this nonsense for so long now. Go back and look over a year ago of the impending doom when people would have to start paying their mortgages that not only didnt materialize prices went up. THe same posters dont question how they were so wrong instead just double down on it.

We are at near record levels of equity in homes, and you chucklefish keep talking about a RE crash. New Home starts are falling off a cliff but somehow even less supply is going to make the prices go down and millennials have just begun establishing new households. Must work for the Whitehouse economic team.

Yet if I asked any of the people saying this, "do you think the dollar is being de valued?" the response would be an overwhelming yes but somehow you then think the most critical hard assets valued against that currency are going to crash. Please make it make sense. This is nothing but missing out angst. People are pissed at RE prices so logically they must crash, hiding the fact all the people saying that are salivating at the chance to BUY and are upset the prices have got away from them.

I don't believe we have any substantive YoY decline in the avg national home price (>5%) and it won't surprise me if we don't get any at all. Even if it were to drop 5% from here it would still be up on the year. It sucks I know, but people really need to stop forming opinions on their feels and what they want the situation to be. Assets that crash are assets that nobody freaking wants at any price. The fact you want them to decline is why they wont.

This is not crypto or some no profit tech company. I don't go buy fagcoin just because it drops 70% because I don't give a shit about fagcoin and it has no tangible value . People are desperate for housing and we are the lowest levels of supply that we have ever seen in our lives. Do the math. What's more likely to happen is even less activity if that is possible. Meaning crazy low level of transactions. This problem doesn't go away until we find away to get a lot more houses on the market.

Affordability will always keep some lid on prices people may be desperate for a home but they still can only afford what they can afford. The net result is no sales, nobody builds anything, nobody moves. It's just a giant pent up demand for any unit that become available that the best off buyers can afford. We under built for over a decade after GFC .

Look at this chart. Realize we aren't even at 1970s level of production of housing units with a much larger population, and then everyone can start making posts that make a modicum of sense. We aren't even producing at replacement+pop growth rate and housing starts are in bad decline right now.

View attachment 424099

Some of these parts of the country austin, denver, etc. found the affordability "limit" that is not a pending crash, the voracious buyers aren't gone. The moment becomes affordable they will be right back bidding away. For it to crash you must have aseller who MUST sell and no willing buyer, meanwhile people are sitting on super affordable low interest mortgages and a shit ton of equity.

"Chucklefish"

<Wall of text>

Lol

This is much more common that you realize., I see it all the time a 1/2 Bath just off the kitchen tucked neatly under the stairs. More and more 1/2-2 Story home designs lack a Bedrom on the first floor so a full Bath is unneeded and just takes up real sq.ft., the under stairs trick is a very common solution.this looks like a badly placed 1/2 bath considering it's right across from an open kitchen, next to dining, like you couldn't make that into a storage closet?

what is the purpose of that structure coming out from the top of the bathroom?

Share: