Investing General Discussion

- Thread starter Furious

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Thats my girl Janet.JPow: "Rates need to be higher vs previously expected."

Theres the index drop.

- 1

Just a little bit of advice. Be cautious reacting to the first move. The presser that follows probably has more influence than the actual rate hike.

- 2

- 1

- 1

For some companies yes, not all though. I believe in the pillars.In a recession, "historically low" PE always looks great until the Earnings revisions lower start to hit.

- 1

Semis holding up better than I had envisioned.Interesting to note, VIX is still dropping in all of this press conference mess.

Jysin

Bronze Baronet of the Realm

- 7,186

- 5,712

That was, by far, the most confusing flip flopping Q&A I have ever seen out of Powell.

First it was inflation progress, then none. Then talking a pause in next meeting or two, then flat out saying (twice) "not a time to be thinking or talking pauses". Then talking about avoid a recession window narrowing, but yet "still doable".

The guy was just all over the place. Uncertainty doesn't bode well for markets.

First it was inflation progress, then none. Then talking a pause in next meeting or two, then flat out saying (twice) "not a time to be thinking or talking pauses". Then talking about avoid a recession window narrowing, but yet "still doable".

The guy was just all over the place. Uncertainty doesn't bode well for markets.

- 3

- 1

JPM analysts once again are wrong. "0.5 - 1% drop" Newp.It's all about the Fed.

Here is the JPM playbook for the week:

- 50 basis point hike, with a dovish press conference: “It is difficult to conceive of a scenario where this outcome occurs given inflation levels and a tight labor market,” the team wrote. “Should this outcome occur, the immediate reaction could produce a double-digit one-day return for equities.” S&P 500 up 10% to 12%

- 50 basis point hike and a hawkish press conference: An outcome that could stem from a Fed that is increasingly concerned about financial stabilities as it balances growth and inflation. S&P 500 up 4% to 5%

- 75 basis point hike and a dovish press conference: A scenario viewed as having the second-highest probability of playing out. “If you saw the Fed give explicit guidance for the December meeting, then that is likely viewed as a dovish outcome.” S&P 500 up 2.5% to 3%

- 75 basis point hike and a hawkish press conference: “This is the most likely outcome with Powell retaining optionality for December and 2023 meetings while emphasizing the current risks to inflation moving higher.” The team also views this as the outcome most expected by bond markets, so says there may not be a significant move in yields that keeps equities from melting down. S&P 500 down 1% to up 0.5%

- 100 basis point hike and a dovish press conference: While this is seen as unlikely as a 50 basis point hike, it may mean the Fed both wants a higher terminal rate and wants to complete the tightening cycle this year. “Separately, the market may digest this move as the Fed having prior knowledge of where next week’s CPI prints.” S&P 500 down 4% to 5%

- 100 basis point hike and a hawkish press conference: Considered the best outcome for equity bears waiting for this latest rally to dissipate. “Here this would seem to be a Fed reassessing its own inflation forecasts, which some investors feel is too optimistic.” S&P falls 6% to 8%, likely resting year-to-date lows

- 1

Anyone wanting to dabble with AMZN, its coming up on a serious support level. The $86/$87 range has like 6 months of support. This is where I aim to jump back in.

- 2

Jysin

Bronze Baronet of the Realm

- 7,186

- 5,712

Fwiw*My take:

Any clues about "only 50bp" and/or pausing thereafter will likely take the market back up in a hurry. I don't expect this and we likely just get "data dependent" as usual. Any extra hawkish talk of continued hikes beyond their "target rate" or "no pauses anytime soon" can send us lower in a hurry.

Burns

Avatar of War Slayer

There are always bonds with EU banks. As a thought, have you looked into your current investment bank, to see if they will hold and allow you to trade with Euros? You could trade on the various EU markets and they have index funds over there too.Nexo is not a bank, it's more like one of those CeFI crypto lending platforms. I store my coins there because they earn same token interest and I don't have as much fear as others on the platform security. They seem to be legit, claim to offer insurance and are making deals with legitimate US banks and stuff. Anyway at some point recently they said all existing stuff keeps earning interest but no new deposits will due to whatever is going on with US & government regulation.

I did not intend to turn this sum of money which is fairly substation into crypto, but I would have left it on Nexo as EUR until the exchange rate became more favorable. I could have just exchanged it on the platform and done a direct deposit....ohh well.

So now I have this money just sitting idle. I have a purpose for it so I'm not looking to take any "high" risk chances, I do want the money. I just don't need it ASAP so I figure waiting 6-12 months for the exchange rate to not blow is no sweat off my back....with this sum of money waiting for the exchange rate to go back to 1:1.10 or even higher is a pretty big deal. I'm not into FOREX stuff or currency crap at all and maybe the rate will never recover or my amount will just take it in the ass for 12 months due to inflation and I should have moved it and eaten the "loss"....that's what I am debating. But waiting 12 months for an extra 10% if the exchange rate recovers sounds perfectly fine by me

For example, Interactive Brokers lets you currency trade, and trade on the Euro markets with local currency. If you have more than $100,000 with them, their fees become competitive.

- 1

BoE raises rates by 75 basis points. Largest hike in over 30 years.

finance.yahoo.com

finance.yahoo.com

Bank of England makes historic rate hike despite 'very challenging' outlook

The Bank of England raised interest rates by the most since 1989 on Thursday but warned investors that the risk of Britain's longest recession in at least a century means borrowing costs are likely to rise less than they expect. The BoE increased Bank Rate to 3% from 2.25% and warned that the...

- 2

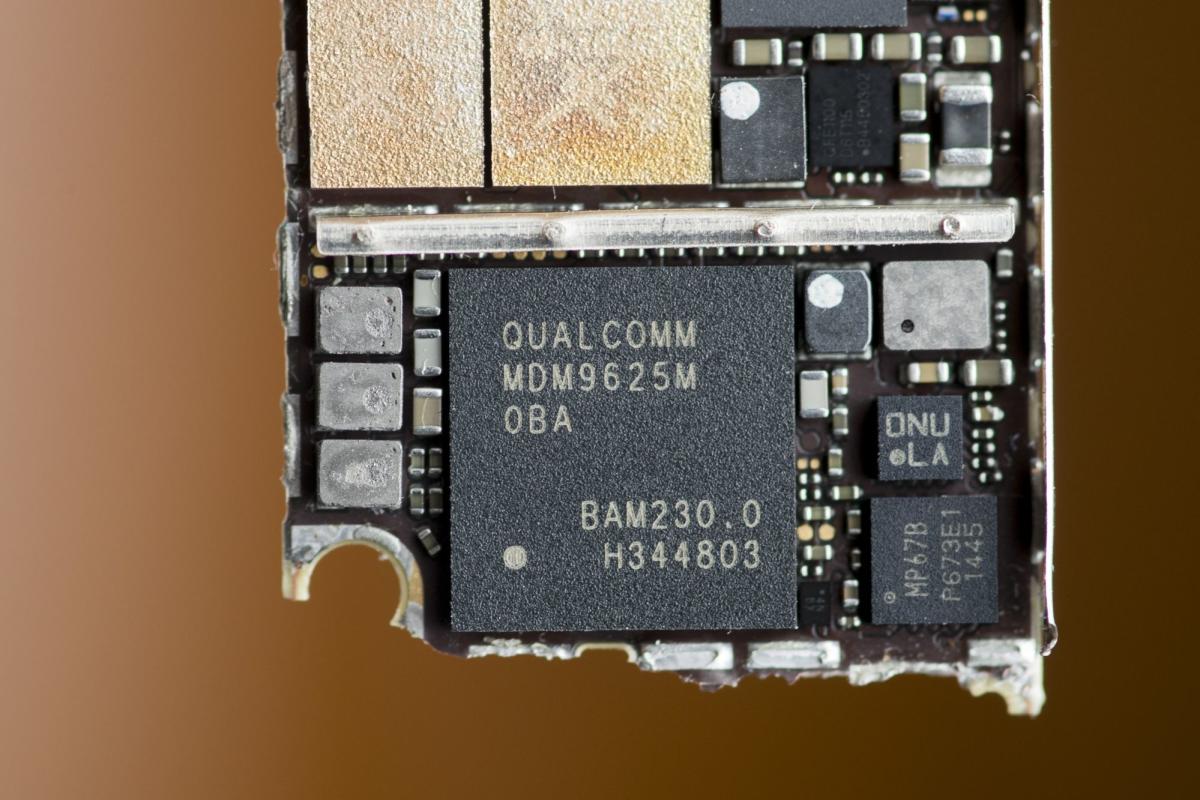

QCOM has my interest. I have owned it before but AAPL dumping their chips was a downer. Article out says AAPL will be using QCOM chips through 2023. This could be a decent play with its earnings and forecast from yesterday driving the price down.

finance.yahoo.com

finance.yahoo.com

Apple to Keep Qualcomm Chips in 2023 in Turnabout

(Bloomberg) -- Qualcomm Inc. will continue to provide the modem chips for the “vast majority” of iPhones in 2023, a turnabout for a company that had expected to lose the business to Apple Inc.’s homegrown components. Most Read from BloombergTwitter Now Asks Some Fired Workers to Please Come...

- 1

Share: