Investing General Discussion

- Thread starter Furious

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

- 49,461

- 108,872

I'm still underwater on it lol

- 3

- 1

ShakyJake

<Donor>

Could've made 2 grand off that single FDX straddle. EVERY time I try something with the paper account I win. If I do it for real, I lose. WTF.And I did a straddle play with them on the paper account. God damnit.

- 1

Analyze the differences between your paper trades and real ones. If you can't see a difference then it could just be bad luck. I am hesitant though if you are saying you always win doing paper straddles. I say this because there is no 100% "I win" strategy. If you aren't ever taking a loss in paper trades it sounds like something there is flawed.Could've made 2 grand off that single FDX straddle. EVERY time I try something with the paper account I win. If I do it for real, I lose. WTF.

ShakyJake

<Donor>

No, it's not specifically straddles. What I meant was, every time I try a different strategy on paper it's green. For this, I was testing a straddle play prior to an earnings call. My gut instinct was FDX was going to be really good or really bad.Analyze the differences between your paper trades and real ones. If you can't see a difference then it could just be bad luck. I am hesitant though if you are saying you always win doing paper straddles. I say this because there is no 100% "I win" strategy. If you aren't ever taking a loss in paper trades it sounds like something there is flawed.

About straddles: I've searched YouTube for videos specifically talking about these and nearly all discourage them. But, when you think about it, your odds are 66%, right? Stock goes up, you win. Stocks goes down, you win. The only losing direction is sideways. The only difficulty is knowing when a move is coming. However, if you buy enough time, it'll eventually occur.

- 1

Captain Suave

Caesar si viveret, ad remum dareris.

- 5,926

- 10,168

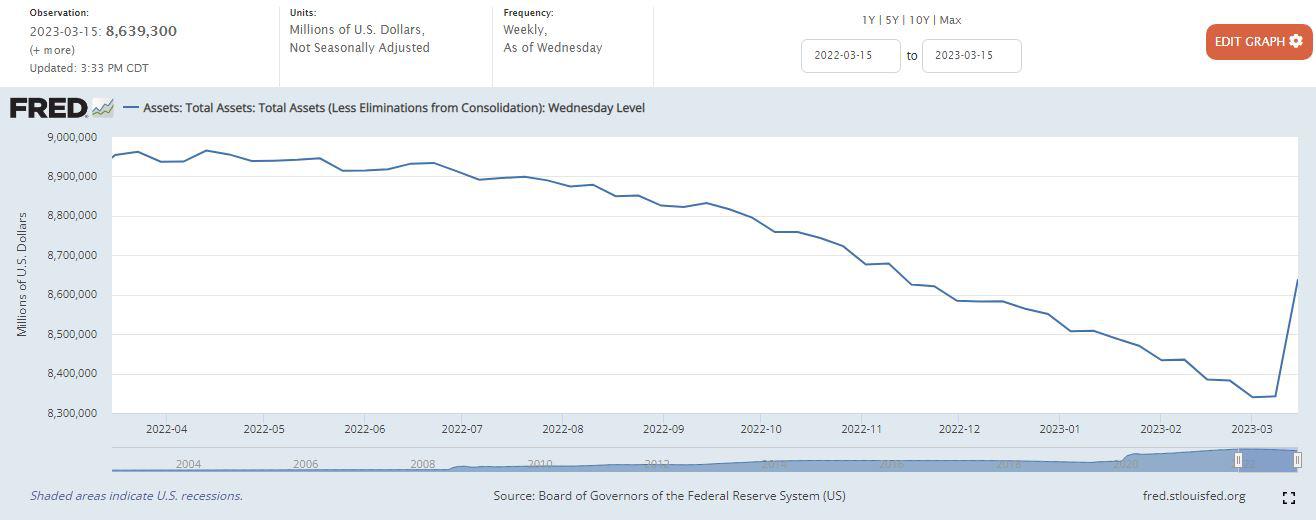

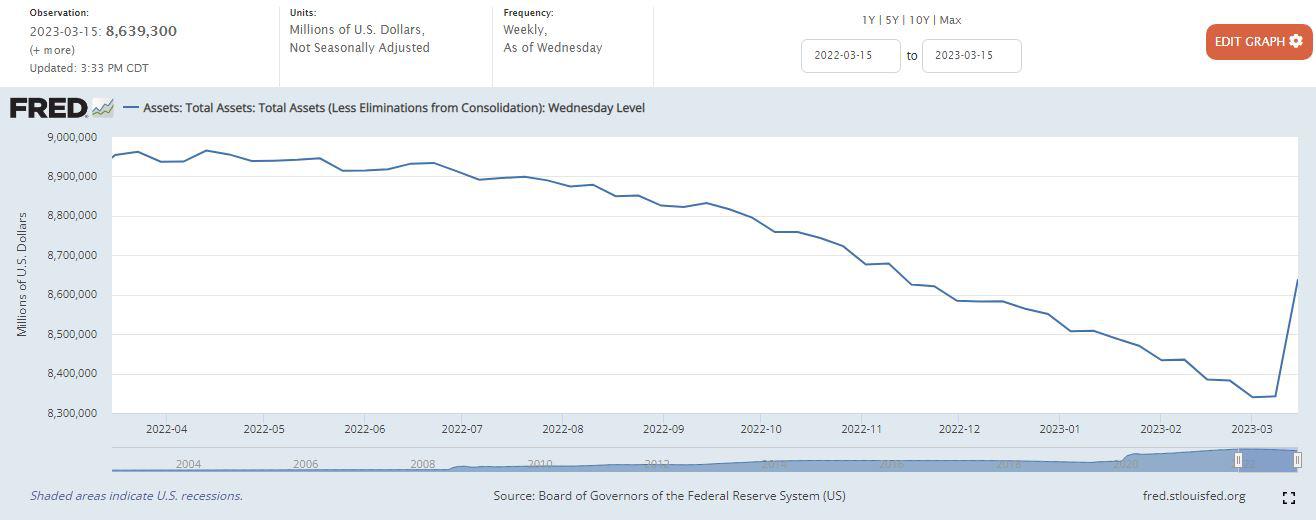

We're so fucking fucked lmao. Welcome to our hyperinflation future I guess

I hate charts with non-zero Y axes. That's a net 3 percent fall in 12 months.

- 1

As long as they don't give the money to poor people to buy food we'll be fine.We're so fucking fucked lmao. Welcome to our hyperinflation future I guess

- 615

- 383

Not exactly. You dont just need movement, you need "enough" movement to create a profit after accounting for the losing side of the option. You are betting on either an up or down movement, yes, but this guarantees at least one of the two bests will lose. So sideways movement you lose both bets, movement in either direction is an auto lose for one bet "but" you need enough movement on the other side to cover the cost of the premium paid on winning side "plus" the cost of the premium on the losing side. You can get a nice 3% move but based on IV and the Greeks that money made on the 3% may not be enough to cover the cost of both premiums.But, when you think about it, your odds are 66%, right? Stock goes up, you win. Stocks goes down, you win. The only losing direction is sideways. The only difficulty is knowing when a move is coming. However, if you buy enough time, it'll eventually occur.

The options calculators will actually give you a good idea of the exact price action you need to break even on a straddle/strangle.

Be ready for some pretty big moves today. Closing below 200d for S&P would be meaningful. Really trying not to put on my bear party hat on but I do hope it's the direction, still think we'll be better off on the long run with a more conventional bear market low flush out.

- 3

- 1

ShakyJake

<Donor>

Right, I've tried using the one built into Thinkorswim . I understand the "V" graph, but it always shows profitable regions way further out than what I'm experiencing, probably due to IV.The options calculators will actually give you a good idea of the exact price action you need to break even on a straddle/strangle.

I'm wondering, since the market is extremely volatile, that straddle plays are a good bet right now. I just sold my single QQQ straddle for a $500 gain. I'll re-enter a bit later when things calm down for the CPI report next week.

I 100% agree that market volatility is profitably right now. I cant speak to ThinkorSwim, I use Fidelity ATP.Right, I've tried using the one built into Thinkorswim . I understand the "V" graph, but it always shows profitable regions way further out than what I'm experiencing, probably due to IV.

I'm wondering, since the market is extremely volatile, that straddle plays are a good bet right now. I just sold my single QQQ straddle for a $500 gain. I'll re-enter a bit later when things calm down for the CPI report next week.

- 615

- 383

Jysin

Bronze Baronet of the Realm

- 7,186

- 5,712

If you cant make reliable money trading straight equities, the last thing you need to be doing is playing with options strategies. Complete understanding of the underlying is critical before adding half a dozen other complex variables on top of that.

- 1

- 1

- 615

- 383

- 18,655

- 50,617

Picked up some MP today. It’s always been one I’ve watched and kept saying I’d buy when it gets in the 20s. It hits 20s, I don’t buy, then it goes back up to mid 30s, every time. Now that I bought it it’ll probably take a shit down into the teens for a couple years.

- 4

I like the stock and its always on my watch list. I generally play it with writing puts at prices I wont mind if I get assigned. Tesla's announcement of them designing a new motor that takes little to no rare earths is the big unknown. I am watching the $20 and $22.5 strikes if we get a crash into the close today to write some more puts.Picked up some MP today. It’s always been one I’ve watched and kept saying I’d buy when it gets in the 20s. It hits 20s, I don’t buy, then it goes back up to mid 30s, every time. Now that I bought it it’ll probably take a shit down into the teens for a couple years.

- 1

Share: