Bitcoins/Litecoins/Virtual Currencies

- Thread starter Tripamang

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Jysin

Bronze Baronet of the Realm

- 7,186

- 5,712

They still look dumb as fuck and I wouldn’t hang them in a kindergarten classroom.

was thinking about finding some cheap nfts to buy and hold for fun then my wife was in the other room watching CBS's Big Brother and I kept hearing nft this and nft that, thinking I was going crazy. Nope, they did an NFT themed challenge

ya I think i'll pass

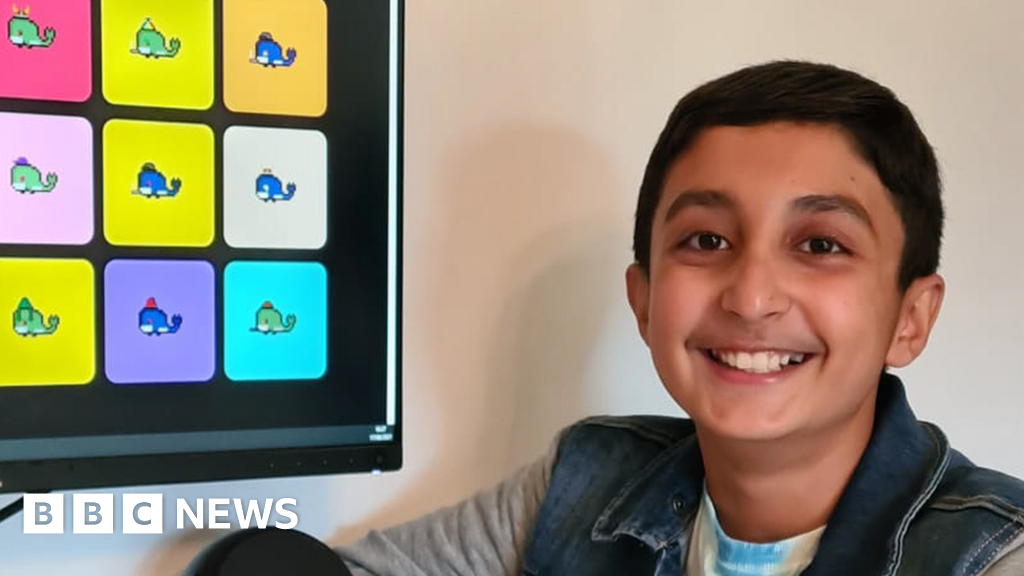

Twelve-year-old boy makes £290,000 from whale NFTs

Benyamin Ahmed created a set of more than 3,000 whale images and sold digital tokens of them.

Yea this shit isn’t modern day tulips or anything..

- 3

- 1

Flobee

Ahn'Qiraj Raider

- 3,169

- 3,689

99% of this space is garbage. Most current iterations of NFTs included. Just because dummies are getting scammed for big $$$ doesn't make it legit. Everyone makes money on a scam until the rug pulls.

ETH is killing its main use-cases. This is directly related to what I was talking about previously.

Bitcoin is signal, the rest is noise.

ETH is killing its main use-cases. This is directly related to what I was talking about previously.

Bitcoin is signal, the rest is noise.

- 10,833

- 19,326

99% of this space is garbage. Most current iterations of NFTs included. Just because dummies are getting scammed for big $$$ doesn't make it legit. Everyone makes money on a scam until the rug pulls.

ETH is killing its main use-cases. This is directly related to what I was talking about previously.

Bitcoin is signal, the rest is noise.

DeFi vs ETH? I don’t understand the comparison.

Flobee

Ahn'Qiraj Raider

- 3,169

- 3,689

If price of ETH goes up, and the price of transactions goes up, that's bad for DeFi platforms that require ETH transactions to function. DeFi is already bleeding out to other (more centralized) chains... which defeats the entire purpose. Shooting themselves in the foot for $$$ denominated gains IMO.DeFi vs ETH? I don’t understand the comparison.

At least they have $500k rocks though

- 2

99% of this space is garbage. Most current iterations of NFTs included. Just because dummies are getting scammed for big $$$ doesn't make it legit. Everyone makes money on a scam until the rug pulls.

ETH is killing its main use-cases. This is directly related to what I was talking about previously.

Bitcoin is signal, the rest is noise.

I believe he's applying a false causality to things here. Here's why...

BTC skyrocketed earlier this year. ETH followed... and everything altcoin (including Defi) were wake surfing behind ETH.

BTC hard corrected, I remember being glad I also had ETH. Then IT hard corrected behind it... ANd lo' and behold the wake surfers followed.

The timing of this suppression in the Defi space isn't IMHO caused by anything related to EIP-1559. It has to do with the fact that when things correct hard, people move to safety. And actively working the Defi space and trading there isn't that yet. They moved back into BTC and to a certain degree ETH, and if they're like me they parked funds in stable things (like DAI) and let them sit, which would cause exactly what you see in those charts, fewer active addresses, and lower activity levels (i.e. transfer volume).

Add into this the fact that many of those Defi projects listed there are becoming "old" by DeFi standards and newer projects are offering better yields in many cases, which will draw activity away. For instance, I had stashes on AAVE for a while, now they've all moved because other projects are offering better yields.

The real risk to ETH right now is that it's starting to no longer be the best game in town. If ADA smart contracts really hit and really work, with as easy as it is supposed to be to port projects to ADA, or support both chains, that isn't good for ETH. I wonder how Polygon activity plays into that? I notice they don't even mention Quickswap (who'se token has been holding price decently lately) The question will be if/when there's a more level playing field between chains/offerings can ETH compete against faster transactions and lower gas fees elsewhere?

As for DeFi, the smart projects are already positioning to support multiple chains as to stop just wake surfing behind ETH. But people will have to want to get active in the DeFi space again, which will happen if a recovery of the market as a whole does.

Of course I could also be some crazy old guy on the interwebs.

- 1

Flobee

Ahn'Qiraj Raider

- 3,169

- 3,689

Thats not unreasonable at all. This could for sure be a short term trend that doesn't stick. I do think other smart contract platforms will eat into ETH marketshare if they don't solve the scaling issues. Its simply too expensive to use and these centralized competitors can lower fees because they don't make the same sacrifices ETH makes for decentralization. Every step down the alt-coin ladder makes sacrifices like this and smart contract platforms seem to be a race to the bottom. 95% of users in this space don't understand or care about actual decentralization and they'll follow the cheapest platform that provides yield (see BNB).Of course I could also be some crazy old guy on the interwebs.

I'm curious to see if Ethereum can scale without centralizing further to compete.

- 15,048

- 22,119

Twelve-year-old boy makes £290,000 from whale NFTs

Benyamin Ahmed created a set of more than 3,000 whale images and sold digital tokens of them.www.bbc.com

Yea this shit isn’t modern day tulips or anything..

I was just comin here to post this.

12-year-old reportedly set to earn $400K in two months selling NFTs

A 12-year-old whiz kid from London who doesn’t even have a bank account is reportedly set to rake in about $400,000 in just two months from creating and selling NFTs.

This kid is going places. He's forward-thinking, regardless of how idiotic you might think NFTs are.

- 1

- 1

- 10,833

- 19,326

I was just comin here to post this.

12-year-old reportedly set to earn $400K in two months selling NFTs

A 12-year-old whiz kid from London who doesn’t even have a bank account is reportedly set to rake in about $400,000 in just two months from creating and selling NFTs.nypost.com

This kid is going places. He's forward-thinking, regardless of how idiotic you might think NFTs are.

I thought the same thing when I saw his picture. Definitely going to be innovating in the crypto/NFT space in the future.

- 14,472

- 27,164

centralizing

You literally repeat this like leftists repeat Nazi...

Nothing to do with the merit of what your saying, just noticed this is your liberally applied no no word

- 1

Children are self banking with crypto.

Imagine these kids trying to use traditional banking services after paying with lightning and QR codes. "You mean I have to type all this shit in? What the fuck is a CVV2 number?" "The fuck is an overdraft fee? Why the hell can't it just immediately deny the payment if it's empty?" "Log in to see my balance? what is this the dark ages?" "The 'high-yield' savings account is 0.5% APY? LMAO who does this?" "What? The bank opened accounts in their client's names against their consent or knowledge and charged them fees on these fake accounts and people still use this place?"

Imagine these kids trying to use traditional banking services after paying with lightning and QR codes. "You mean I have to type all this shit in? What the fuck is a CVV2 number?" "The fuck is an overdraft fee? Why the hell can't it just immediately deny the payment if it's empty?" "Log in to see my balance? what is this the dark ages?" "The 'high-yield' savings account is 0.5% APY? LMAO who does this?" "What? The bank opened accounts in their client's names against their consent or knowledge and charged them fees on these fake accounts and people still use this place?"

- 4

MachRed

Molten Core Raider

- 192

- 454

I believe he's applying a false causality to things here. Here's why...

BTC skyrocketed earlier this year. ETH followed... and everything altcoin (including Defi) were wake surfing behind ETH.

BTC hard corrected, I remember being glad I also had ETH. Then IT hard corrected behind it... ANd lo' and behold the wake surfers followed.

The timing of this suppression in the Defi space isn't IMHO caused by anything related to EIP-1559. It has to do with the fact that when things correct hard, people move to safety. And actively working the Defi space and trading there isn't that yet. They moved back into BTC and to a certain degree ETH, and if they're like me they parked funds in stable things (like DAI) and let them sit, which would cause exactly what you see in those charts, fewer active addresses, and lower activity levels (i.e. transfer volume).

Add into this the fact that many of those Defi projects listed there are becoming "old" by DeFi standards and newer projects are offering better yields in many cases, which will draw activity away. For instance, I had stashes on AAVE for a while, now they've all moved because other projects are offering better yields.

The real risk to ETH right now is that it's starting to no longer be the best game in town. If ADA smart contracts really hit and really work, with as easy as it is supposed to be to port projects to ADA, or support both chains, that isn't good for ETH. I wonder how Polygon activity plays into that? I notice they don't even mention Quickswap (who'se token has been holding price decently lately) The question will be if/when there's a more level playing field between chains/offerings can ETH compete against faster transactions and lower gas fees elsewhere?

As for DeFi, the smart projects are already positioning to support multiple chains as to stop just wake surfing behind ETH. But people will have to want to get active in the DeFi space again, which will happen if a recovery of the market as a whole does.

Of course I could also be some crazy old guy on the interwebs.

This is what I’ve seen as well. TVL is near ATH despite ETH stagnating at 3200ish. Terra Avalanche and Solana are the recent pump coins and its no coincidence capital has been flowing to those chains.

Last edited:

Flobee

Ahn'Qiraj Raider

- 3,169

- 3,689

True. Its exactly what altcoins do though. Smart contract platforms were forked from Bitcoin, and they all make decentralization sacrifices from that base so that they can increase transaction complexity and volume while struggling to keep cost down. There are no free lunches. Everyone apes into the coin based on the promise that its decentralized when it generally isn't. At least not to the degree claimed.You literally repeat this like leftists repeat Nazi...

Nothing to do with the merit of what your saying, just noticed this is your liberally applied no no word

Burden of proof should be on each and every project to demonstrate why and how it is decentralized but as the space moves further and further from its origins your average user doesn't have the technical chops to understand, and they simply don't care so long as number go up. Its worth noting that its MUCH cheaper to run a database centrally than it is in a distributed fashion. It won't be and isn't uncommon at all to run a blockchain centrally, claim its distributed, and reap the benefit of incredibly cheap transactions and high throughput.

Last edited:

Another thing I think might be suppressing DeFi as a space right now is that there's a new "coolest thing to do" around which is sucking all the liquidity up. That being the current NFT craze. If you look at the volume that just OpenSea has done over the last month they've had around $1 Billion in transaction volume. That's speculative investing liquidity which ISN'T going into DeFi projects, and if anything is pulling money OUT of Defi to invest in NFTs. As we still haven't had the true "Mass adoption" event moment for Crypto as a whole you have to accept that there's a finite about of money in the pool. If NFT's crash/correct (which I suspect they eventually will due to oversaturation of offerings) I suspect part of that will flow back into DeFi as that's the place to store value and earn yields between speculations.

- 1

James

Ahn'Qiraj Raider

- 2,804

- 7,056

If NFT's crash/correct (which I suspect they eventually will due to oversaturation of offerings) I suspect part of that will flow back into DeFi as that's the place to store value and earn yields between speculations.

NFTs will be incorporated into DeFi much more comprehensively than they are today is what will happen - note that NFTs are already a store of value, and can already earn yield depending on the project. I think we'll see a lot of NFT projects consolidating or being left behind, animals facing 30 degrees right can only last so long you know. Inclusion into the Metaverse is already well past the 1 ETH floor on 10k mints, a lot of projects won't make it that high.

- 1

NFTs will be incorporated into DeFi much more comprehensively than they are today is what will happen - note that NFTs are already a store of value, and can already earn yield depending on the project. I think we'll see a lot of NFT projects consolidating or being left behind, animals facing 30 degrees right can only last so long you know. Inclusion into the Metaverse is already well past the 1 ETH floor on 10k mints, a lot of projects won't make it that high.

I agree with you on NFT's being more integrated. Also my standing theory is that the true value of NFTs will be when NFTs move beyond just a store of value or "art" and are representations of limited virtual items, and those items have a purpose. For instance, your membership at the Gym might be an NFT, a very exclusive gym might say they would only ever had X number of members, justifying the higher premium and your "gym key" is the NFT that could be sold. Same with video games, ownership of a game would be an NFT.

This would solve a huge problem in the music/gaming/media industry. The original producers of media get nothing when their products are resold on the secondary market. NFT's solve this. Each NFT could be encoded so that the original artist/game studio/rights owner makes a percentage of every secondary sale of the item.

James

Ahn'Qiraj Raider

- 2,804

- 7,056

By the way, who is this Zzen retard that keeps emoting my posts like they don't understand basic shit while not commenting a single time in the thread? Not a good look, bro, brain damage is serious business.

I mean, this is my standing theory on crypto as a whole. The space will not grow up until it moves beyond Bitcoin for the exact same reason -- there's no utility, it has not even come close to replacing our banking infrastructure.

This really depends on the utility, imo. Those kinds of taxes can be entirely circumvented by using a wrapper, which we don't see too often on these art projects but I'll bet you $20 that you'd see it with basketball tickets sold via NFT.

Also my standing theory is that the true value of NFTs will be when NFTs move beyond just a store of value or "art" and are representations of limited virtual items, and those items have a purpose.

I mean, this is my standing theory on crypto as a whole. The space will not grow up until it moves beyond Bitcoin for the exact same reason -- there's no utility, it has not even come close to replacing our banking infrastructure.

Each NFT could be encoded so that the original artist/game studio/rights owner makes a percentage of every secondary sale of the item.

This really depends on the utility, imo. Those kinds of taxes can be entirely circumvented by using a wrapper, which we don't see too often on these art projects but I'll bet you $20 that you'd see it with basketball tickets sold via NFT.

- 1

Share: