- 15,767

- 78

At least with the commute you're not risking your entire financial future and ability to retire.

Unless somebody takes you out on the way to or from work.

At least with the commute you're not risking your entire financial future and ability to retire.

Local credit union offers a 5/5 ARM (rather than 5/1 like most banks) with minimum 5% down and PMI waived, rate capped at 6% above the initial rate.

Given the current financial situation and the fact that fiscal conservatives have been purged from both parties, I don't really see any significant increase in rates in the near future. Would anyone jump on this, or would they still stick with the fixed?

I can't imagine you'll see rates much lower than they currently are. So if you do fixed, you've locked that in for 30yrs. Versus ARM with little chance of the rate adjusting down, and all the likelihood of it going up. No PMI is definitely nice, but would you be putting that PMI money into savings/investments so it can offset the rate going up later? Or would you be going this route to stretch yourself on a more expensive house with the expectation that your income will scale up as the interest rate goes up. Do you have or plan to have kids? They do a damn good job of eating up that income growth.

I can't imagine you'll see rates much lower than they currently are. So if you do fixed, you've locked that in for 30yrs. Versus ARM with little chance of the rate adjusting down, and all the likelihood of it going up. No PMI is definitely nice, but would you be putting that PMI money into savings/investments so it can offset the rate going up later? Or would you be going this route to stretch yourself on a more expensive house with the expectation that your income will scale up as the interest rate goes up. Do you have or plan to have kids? They do a damn good job of eating up that income growth.

It helps to get a clear look at the PMI cost, too. 5% down on a 460,000 home was like $90 a month for us. It's basically another phone bill.

On a 460,000 house with 5% down, the PMI is on 437,000, at .5% that's 182 per month.

On a 460,000 house with 5% down, the PMI is on 437,000, at .5% that's 182 per month.

So I put an offer on a nice house about 2 weeks ago. It went on the market Wednesday. I saw it Monday after work and put an offer on it the same day but some other people won the bid. I started $14k under asking and went to $6k over asking while the owner's realtor kept telling my realtor they had 2 nearly identical offers the whole way... Really pissed me off I lost that one with "close offers" even though I went up $20k.

Bout a week I was pissed off and didn't even want to home shop. My roommates were complete dickheads one day when I was trying to write some documents for work. Huge fight and I got back to home shopping.

I saw this awesome fixer upper that was foreclosed on. Saw a finished house but it was meh... Then I saw the house I'm currently working to put an offer on. It's almost finished new construction, really nice. It's down in Stafford as someone recommended earlier in this thread. We'll see how it goes. I'm hopeful...

Made it past appraisal, which came in at 520. I think this is another rigged system to always place the value just above what you paid.

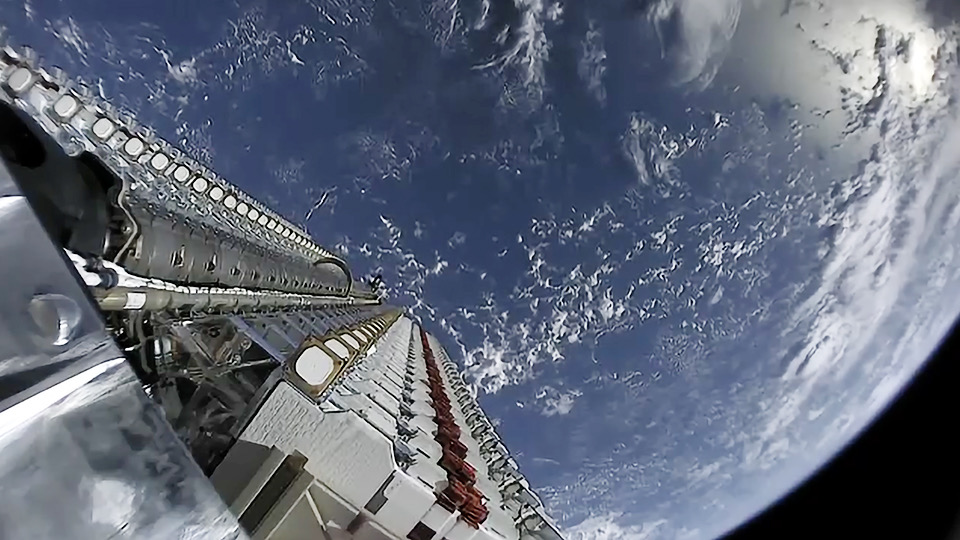

FWIW this is supposed to be coming soon. Should solve internet problems for those outside cities.High speed internet is going to be an issue, I'm looking into wireless ISPs and I'm actually testing out unlimited SIMs from Welcome | Unlimitedville right now.