Investing General Discussion

- Thread starter Furious

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

So I have a question for everyone. I do the majority of my trading/investing in my IRA as it's my biggest account. I also have a brokerage account that is smaller (under 100k) that I use to park cash for investments and also cash I might need short/mid term.

My question is one of investing choices. What happens is I see a stock (let's say AAPL) and I own a chunk in my IRA. I then shy away from owning it in my Brokerage account because I don't want to go too overweight in a single stock. This leads me to generally using index ETFs in the brokerage. If I see an opportunity pop my first inclination is to invest in it via my IRA and then I am back to not wanting to also have it in the Brokerage for weight issues.

Should I just have a total portfolio weight (combined from all my investment accounts) and use that weighting? I tend to always lean to the IRA as first choice for investing due to tax advantages.

Thoughts?

My question is one of investing choices. What happens is I see a stock (let's say AAPL) and I own a chunk in my IRA. I then shy away from owning it in my Brokerage account because I don't want to go too overweight in a single stock. This leads me to generally using index ETFs in the brokerage. If I see an opportunity pop my first inclination is to invest in it via my IRA and then I am back to not wanting to also have it in the Brokerage for weight issues.

Should I just have a total portfolio weight (combined from all my investment accounts) and use that weighting? I tend to always lean to the IRA as first choice for investing due to tax advantages.

Thoughts?

Shonuff

Mr. Poopybutthole

- 5,538

- 792

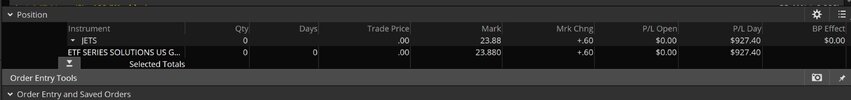

I bought early, I posted yesterday my positions.Massive payday here today.Shonuff this is what I was talking about buying support levels, and leave some cash buying power in case of lower support level moves (pyramid sizing). Picking that Cramer arbitrary buy-in day of Wednesday? Yea.. how did that advice help at all?

SPY right into the 50D here right now. Monster recovery. Buying into weakness, selling into strength.

JETS has been a profitable trade this AM, after LUV reported covid impacts are declining. $927 in the last hour.

Attachments

- 1

Reports are CCP is telling local governments to prepare for worst case scenario regarding EvergrandeThought the bond payments were due Thursday? (re Evergrande)

Jysin

Bronze Baronet of the Realm

- 7,186

- 5,712

yea, I linked that WSJ article this morning.Reports are CCP is telling local governments to prepare for worst case scenario regarding Evergrande

Repost:

WSJ News Exclusive | China Makes Preparations for Evergrande’s Demise

Beijing, reluctant to bail out the country’s most heavily indebted property developer, is asking local officials across the country to prepare for a “possible storm.”

Zzen

Potato del Grande

- 2,975

- 3,685

Lol, Fed might hike rates in 2023 because inflation...

“Begin to taper” is the “just two more weeks” of the investment world.

- 1

Jysin

Bronze Baronet of the Realm

- 7,186

- 5,712

Keep in mind, we get more JPow speak tomorrow to look forward to.

The Federal Reserve Board will host a virtual Fed Listens event on September 24 at 10:00 a.m. EDT, convening representatives from a range of sectors to share their perspectives on the economic recovery from the COVID-19 pandemic.

Fed Listens: Perspectives on the Pandemic Recovery

economic Conference - The Federal Reserve Board of Governors in Washington DC.

www.federalreserve.gov

The Federal Reserve Board will host a virtual Fed Listens event on September 24 at 10:00 a.m. EDT, convening representatives from a range of sectors to share their perspectives on the economic recovery from the COVID-19 pandemic.

Jysin

Bronze Baronet of the Realm

- 7,186

- 5,712

These two really found their footing.DAL and NCLH both held their breakout pivots.

NCLH in particular has cleared a longstanding ~26.4 pivot, 100D, and 200D resistances. Short of some new covid dramas / politics / macro market events, this should be back over $30 soon.

- 1

Shonuff

Mr. Poopybutthole

- 5,538

- 792

Rebought it just now.These two really found their footing.

NCLH in particular has cleared a longstanding ~26.4 pivot, 100D, and 200D resistances. Short of some new covid dramas / politics / macro market events, this should be back over $30 soon.

Shonuff

Mr. Poopybutthole

- 5,538

- 792

members only call is nowReports are CCP is telling local governments to prepare for worst case scenario regarding Evergrande

Jysin

Bronze Baronet of the Realm

- 7,186

- 5,712

Ouch..

A major shareholder in China Evergrande Group EGRNF -12.13% plans to sell all of its stock in the ailing Chinese real-estate developer, potentially incurring losses of more than $1 billion in the process.

Chinese Estates Holdings Ltd. 127 5.50% , which is controlled by Hong Kong billionaire Joseph Lau and his wife, Chan Hoi-wan, said Thursday it had recently pared its stake in Evergrande to about 5.7% from nearly 6.5%, and it was seeking shareholder approval to potentially sell the remainder.

China Evergrande Loses Support of Hong Kong Tycoon Amid Debt Crisis

Billionaire Joseph Lau’s company says it plans to sell all its shares in the real-estate developer

A major shareholder in China Evergrande Group EGRNF -12.13% plans to sell all of its stock in the ailing Chinese real-estate developer, potentially incurring losses of more than $1 billion in the process.

Chinese Estates Holdings Ltd. 127 5.50% , which is controlled by Hong Kong billionaire Joseph Lau and his wife, Chan Hoi-wan, said Thursday it had recently pared its stake in Evergrande to about 5.7% from nearly 6.5%, and it was seeking shareholder approval to potentially sell the remainder.

Honestly, just sell put options on it. It's the best of both worlds play. Example... write the $26 put option for 36 cents. If it doesn't go down you keep the money ($36 per contract). If it does go down below $26 you get it at $26 but got an extra 36 cents so cost basis is $25.64.Looks like I'm probably not going to find a re-entry point with PLTR. Might be time to just cash out my "play" money.

It's not ideal but pick a strike you would be willing to buy at and sell those puts.

- 1

Doing meetings with team from company we just bought. :-(members only call is now

Share: