That is exactly what I am struggling with. I want to put some but just can't come up with a number. I guess I can start small maybe 10% and see if they continue this growth we are seeing. Company has been around 79 years and they have 35 years with making a profit so that kinda reassures me but ENRON lol.Oh. I'd say don't put extra into company stock or an ESOP.

Essentially you're putting all your eggs in the company basket. You already rely on them for salary. Ask Worldcom or Enron employees how that can go wrong.

A good way to look at it is if you currently made $100k and are saving $25k, you're 75% in on your company.

But then, tons of people have become tech millionaires similarly, so it does work out sometimes.

Investing General Discussion

- Thread starter Furious

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

- 27,495

- 40,581

retirement and saving for it is a balancing act. If you just retire at 30, what he fuck will you do with your life living on 30k a year like that plan above. Using myself as an example, I’ll hit my minimum to retire in 5 years with normal market conditions, but I don’t want to retire on the minimum or have to worry about a bad year. For me, hitting my goal is my out. I’ll keep working 5-10 years past when I can retire, but I’ll be pouring the gravy. I won’t need to save if I don’t want to, I won’t need my job.

I think the most important part of planning for retirement is giving yourself room for life to happen.

I think the most important part of planning for retirement is giving yourself room for life to happen.

- 1

Gravel

Mr. Poopybutthole

So you save more. You don't have to use his numbers.retirement and saving for it is a balancing act. If you just retire at 30, what he fuck will you do with your life living on 30k a year like that plan above. Using myself as an example, I’ll hit my minimum to retire in 5 years with normal market conditions, but I don’t want to retire on the minimum or have to worry about a bad year. For me, hitting my goal is my out. I’ll keep working 5-10 years past when I can retire, but I’ll be pouring the gravy. I won’t need to save if I don’t want to, I won’t need my job.

I think the most important part of planning for retirement is giving yourself room for life to happen.

If you spend $80k a year, save $2 million instead.

- 27,495

- 40,581

I agree with the math and plan being possible, it’s the sensibility I’m objecting too. I did a similar calculation myself, but it’s not my grail.So you save more. You don't have to use his numbers.

If you spend $80k a year, save $2 million instead.

Gravel

Mr. Poopybutthole

I mean, to each their own.

You've got so many years on this planet. There's a cliche about how no one is on their death bed wishing they'd worked more.

If you're working an extra 5-10 years for "gravy," just realize you're sacrificing years of your life for money you may never spend. Worse, they're almost definitely the best years you have left (youth and health).

As far as your "bad year," the 4% rule includes two World Wars, Vietnam, the Great Depression, stagflation of the 70's, the dotcom bust...all of it. Now, there are caveats like how it's only a 30 year study (the Trinity study), and the "success" condition is you don't completely run out of money. But it was also super rigid, where in bad years you just keep plugging away with withdrawals without any adjustment. It also doesn't factor in other sources of income that you pick up, nor how you can mitigate sequence of return risk (essentially if you can manage your portfolio from black swan events in the first decade, you're good indefinitely). It also ignores stuff like Social Security (which unless it's completely slashed as a program, will pay out a minimum of what the cash inflows from current workers is; generally state as about 75% of current rates), inheritances, pensions, or even how people spend less in their later years.

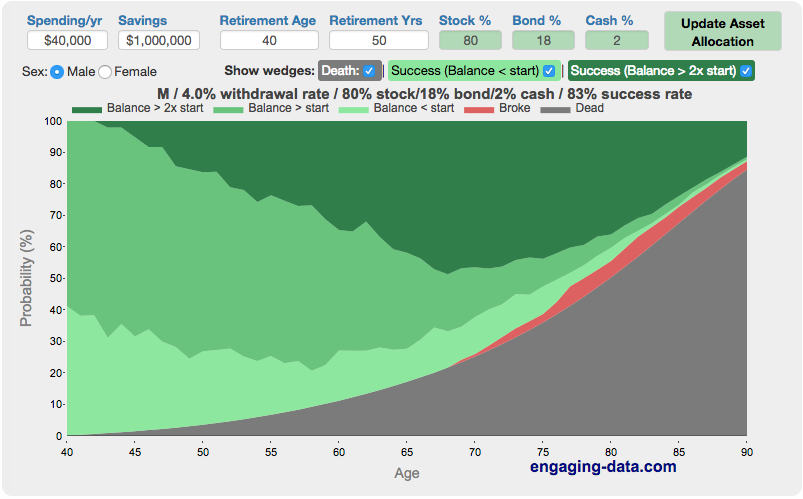

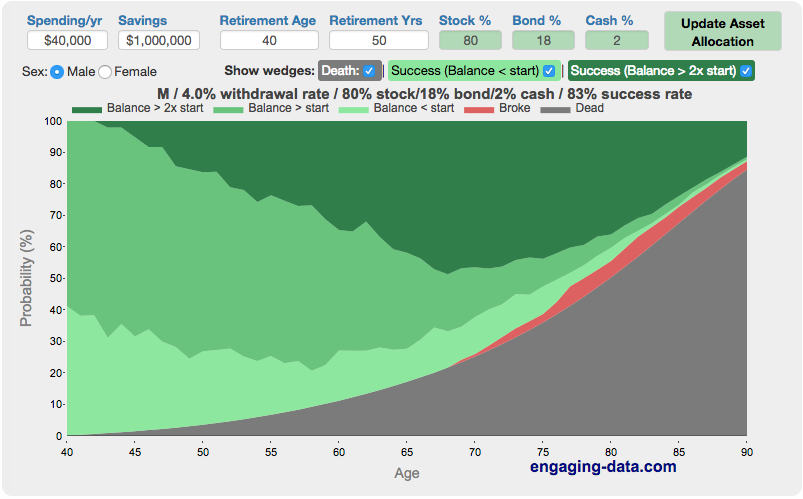

There are calculators I can share that are really good to get a visual of chances of failure. One of my favorites shows how much more likely you are to just die, and how that's a much bigger risk than going broke. They also show the chances of you ending up with multiple times more than you started with. For instance, I just looked it up and was like a 20% chance we end up with 5x more than we started with, and 30% chance 2x (so 50% chance we end up with more money than we know what to do with).

engaging-data.com

engaging-data.com

Attaching a picture of it. The red is the "broke" part people worry about, meanwhile the massive grey one is "dead."

You've got so many years on this planet. There's a cliche about how no one is on their death bed wishing they'd worked more.

If you're working an extra 5-10 years for "gravy," just realize you're sacrificing years of your life for money you may never spend. Worse, they're almost definitely the best years you have left (youth and health).

As far as your "bad year," the 4% rule includes two World Wars, Vietnam, the Great Depression, stagflation of the 70's, the dotcom bust...all of it. Now, there are caveats like how it's only a 30 year study (the Trinity study), and the "success" condition is you don't completely run out of money. But it was also super rigid, where in bad years you just keep plugging away with withdrawals without any adjustment. It also doesn't factor in other sources of income that you pick up, nor how you can mitigate sequence of return risk (essentially if you can manage your portfolio from black swan events in the first decade, you're good indefinitely). It also ignores stuff like Social Security (which unless it's completely slashed as a program, will pay out a minimum of what the cash inflows from current workers is; generally state as about 75% of current rates), inheritances, pensions, or even how people spend less in their later years.

There are calculators I can share that are really good to get a visual of chances of failure. One of my favorites shows how much more likely you are to just die, and how that's a much bigger risk than going broke. They also show the chances of you ending up with multiple times more than you started with. For instance, I just looked it up and was like a 20% chance we end up with 5x more than we started with, and 30% chance 2x (so 50% chance we end up with more money than we know what to do with).

Rich, Broke or Dead? Post-Retirement FIRE Calculator: Visualizing Early Retirement Success and Longevity Risk - Engaging Data

A FI/RE early retirement calculator visualizing longevity risk in early retirement and enables you to compare the probability success, failure and mortality.

engaging-data.com

engaging-data.com

Attaching a picture of it. The red is the "broke" part people worry about, meanwhile the massive grey one is "dead."

Last edited:

- 10,828

- 19,318

401k accounts are done via the employers. You wife will have to use their plan and provider. You cant have one yourself unless your employers offers it. If you are self employed you can set up a SEP.

There are worksheets you need to check on the IRS page concerning allowable contributions to retirement accounts. It depends on income, your wife's participation etc. Its a pretty simple worksheet. go find it and walk through it for maximums. If not capped then yes those maximums sound right.

FSKAX is Fidelity total market which sounds solid.

Yes on the priority. It assumes you have a good option to invest in in the 401k. If there is no good index available then hit it for the matching fund cap and then go to IRA.

I talked to my CPA and she said that I should just open one in Fidelity as an employee and deposit funds from my personal account, up to $11,090. The taxes owed after funding the SEP at $11,090 would be federal taxes $6,664 and state $792.

You are self employed?I talked to my CPA and she said that I should just open one in Fidelity as an employee and deposit funds from my personal account, up to $11,090. The taxes owed after funding the SEP at $11,090 would be federal taxes $6,664 and state $792.

- 27,495

- 40,581

I mean, to each their own.

If you're working an extra 5-10 years for "gravy," just realize you're sacrificing years of your life for money you may never spend. Worse, they're almost definitely the best years you have left (youth and health).

I get you, so I guess all I can do is inform you why I chose that age. I’ll be 50, and hopefully in good shape. I don’t hate my job and will have the time saved up to take 3-4 month long vacations each year at my pleasure. 50 is when I can withdraw my full pension, so I have a massive financial incentive to go to that. Since I’ll have little financial pressure to save, I’ll have lots more free money to collect the toys I need in retirement. I have about 500k worth of stuff I want to buy, and I’ll be able to get a loan to cover if I need to, but being able to slash that down to a comfortable level will make me have to make a lot less “choices” about what I can do, which is ultimately the absolute most important thing to me in retirement, freedom.

Not saying your plan can’t work, just saying it’s a bad idea to assume that things can’t go wrong when it comes to money. I could die before I get a chance to do it, that’s a risk you take whenever you save any money.

Gravel

Mr. Poopybutthole

That's why I said to each their own. If the information I wrote doesn't apply to you (since you have a pension at 50 you're holding out for), maybe it helps someone else. I'm good with that.I get you, so I guess all I can do is inform you why I chose that age. I’ll be 50, and hopefully in good shape. I don’t hate my job and will have the time saved up to take 3-4 month long vacations each year at my pleasure. 50 is when I can withdraw my full pension, so I have a massive financial incentive to go to that. Since I’ll have little financial pressure to save, I’ll have lots more free money to collect the toys I need in retirement. I have about 500k worth of stuff I want to buy, and I’ll be able to get a loan to cover if I need to, but being able to slash that down to a comfortable level will make me have to make a lot less “choices” about what I can do, which is ultimately the absolute most important thing to me in retirement, freedom.

Not saying your plan can’t work, just saying it’s a bad idea to assume that things can’t go wrong when it comes to money. I could die before I get a chance to do it, that’s a risk you take whenever you save any money.

I will say the whole "I like my job" should always have a caveat of time. You like it now. Having the financial independence to quit if it starts sucking is invaluable. I did it earlier this year. I loved my old job, but then we had a re-org and I fucking hated every single day of it. So I told my boss I thought she was a moron and put in my notice.

It was just kind of a weird coincidence that after I quit, we sold our house, got on the road, and while we were living in a van hiking around Utah, found out we had enough money to retire. I posted around the week that it happened that it felt bizarre to be homeless, but also have enough to retire on, at the same time.

My original plan was to eventually quit anyway and establish residency in Florida to avoid state income tax. I had accepted a job (my current one) thinking I'd do it for 6-12 months. But the 6 weeks of freedom I had convinced me that I fucking hate working anymore. It was amazing being able to pursue hobbies every single day if I wanted. The only reason I'm working right now is because in doing reading about it, it's near impossible to get a mortgage without a working income (this includes traditional retirees I've found, too; lenders don't seem to give much of a shit about anything but cash or salary). So I'm working until we find a place, and I'll quit for good the day after we close.

Kirun

Buzzfeed Editor

You "retired" but didn't have enough money to put in a cash offer on a new home? Wild.That's why I said to each their own. If the information I wrote doesn't apply to you (since you have a pension at 50 you're holding out for), maybe it helps someone else. I'm good with that.

I will say the whole "I like my job" should always have a caveat of time. You like it now. Having the financial independence to quit if it starts sucking is invaluable. I did it earlier this year. I loved my old job, but then we had a re-org and I fucking hated every single day of it. So I told my boss I thought she was a moron and put in my notice.

It was just kind of a weird coincidence that after I quit, we sold our house, got on the road, and while we were living in a van hiking around Utah, found out we had enough money to retire. I posted around the week that it happened that it felt bizarre to be homeless, but also have enough to retire on, at the same time.

My original plan was to eventually quit anyway and establish residency in Florida to avoid state income tax. I had accepted a job (my current one) thinking I'd do it for 6-12 months. But the 6 weeks of freedom I had convinced me that I fucking hate working anymore. It was amazing being able to pursue hobbies every single day if I wanted. The only reason I'm working right now is because in doing reading about it, it's near impossible to get a mortgage without a working income (this includes traditional retirees I've found, too; lenders don't seem to give much of a shit about anything but cash or salary). So I'm working until we find a place, and I'll quit for good the day after we close.

Gravel

Mr. Poopybutthole

Why would I liquidate enough for a house when interest rates are under 3%, when I can keep it in the market earning 7-10% in an average year?

In fact, taking 30% of our net worth and throwing it into a house means suddenly we don't have enough to retire on, because retiring early is 100% dependent on the concept of compound interest. If I use even $100k for bullshit like that, that's 50+ years of it not earning interest.

In fact, taking 30% of our net worth and throwing it into a house means suddenly we don't have enough to retire on, because retiring early is 100% dependent on the concept of compound interest. If I use even $100k for bullshit like that, that's 50+ years of it not earning interest.

- 2

Kirun

Buzzfeed Editor

Eh, fair enough. I get it, but there's no way I'd personally retire if liquidating for a house was 30% of my retirement funds.Why would I liquidate enough for a house when interest rates are under 3%, when I can keep it in the market earning 7-10% in an average year?

- 10,828

- 19,318

Gravel

Mr. Poopybutthole

But how many people are buying houses with 100% cash?Eh, fair enough. I get it, but there's no way I'd personally retire if liquidating for a house was 30% of my retirement funds.

How many people are delaying normal retirement because they still hold a mortgage?

You're essentially arguing that you need to have a paid off house to retire. That seems an odd stance to take.

There's actually a large argument in early retirement community forums that having a mortgage (the longer the better) during early retirement is one of the best things you can do. It becomes your biggest hedge against inflation.

- 1

Enjoy the contribution limits of the SEPYes.

- 1

To be clear on terminology. A 401k is not a SEP. You cant open a 401k on your own but you can definitely open a SEP. The amount you can fund a SEP is a percentage of your profit of your business. I'm not sure why funding a SEP would involve you paying income tax though. The amount you fund a SEP is tax deductible.I talked to my CPA and she said that I should just open one in Fidelity as an employee and deposit funds from my personal account, up to $11,090. The taxes owed after funding the SEP at $11,090 would be federal taxes $6,664 and state $792.

I second this. Keep your retirement money maxed in those tax deferred accounts. If you want company stock consider it play money and use your brokerage account for it. My mom retired from WMT with 100% of her investments in their stock. As good as it is, the first thing I did when I took it over was diversify the shit out of it. WMT is good. WMT plus AAPL, plus MSFT, plus JPM etc is double plus good.Oh. I'd say don't put extra into company stock or an ESOP.

Essentially you're putting all your eggs in the company basket. You already rely on them for salary. Ask Worldcom or Enron employees how that can go wrong.

A good way to look at it is if you currently made $100k and are saving $25k, you're 75% in on your company.

But then, tons of people have become tech millionaires similarly, so it does work out sometimes.

- 1

Kirun

Buzzfeed Editor

I don't follow. Why would having a loan be a better hedge against inflation than owning it?There's actually a large argument in early retirement community forums that having a mortgage (the longer the better) during early retirement is one of the best things you can do. It becomes your biggest hedge against inflation.

There is working because you have to and working because you want to. The latter makes almost any type of job much more enjoyable.retirement and saving for it is a balancing act. If you just retire at 30, what he fuck will you do with your life living on 30k a year like that plan above. Using myself as an example, I’ll hit my minimum to retire in 5 years with normal market conditions, but I don’t want to retire on the minimum or have to worry about a bad year. For me, hitting my goal is my out. I’ll keep working 5-10 years past when I can retire, but I’ll be pouring the gravy. I won’t need to save if I don’t want to, I won’t need my job.

I think the most important part of planning for retirement is giving yourself room for life to happen.

Gravel

Mr. Poopybutthole

Because life is a zero sum game. The assets I tie up in a paid off house are alternatively used as an investment.I don't follow. Why would having a loan be a better hedge against inflation than owning it?

If we're just adding a miracle $300k for a house to my assets, that's fine. But in real life that means I'm working for several extra years.

Alternatively, I can get a mortgage and the numbers work right now. My monthly payment stays the same (versus rent). My investments that would be used for a paid off house are earning 3, 4 or even 5x what my interest rate is. That's the hedge.

Share: