Investing General Discussion

- Thread starter Furious

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Chart is awfully familiar, what are the odds humans go through the same emotional responses with the same problem?

The Fibonacci code presenting itself into the markets.

WTB: Relief Rally. PST

- 1

Chart is awfully familiar, what are the odds humans go through the same emotional responses with the same problem?

The Fibonacci code presenting itself into the markets.

Don't believe a thing that lying shyster says.

- 3

Pogi.G

Silver Baronet of the Realm

- 1,937

- 9,939

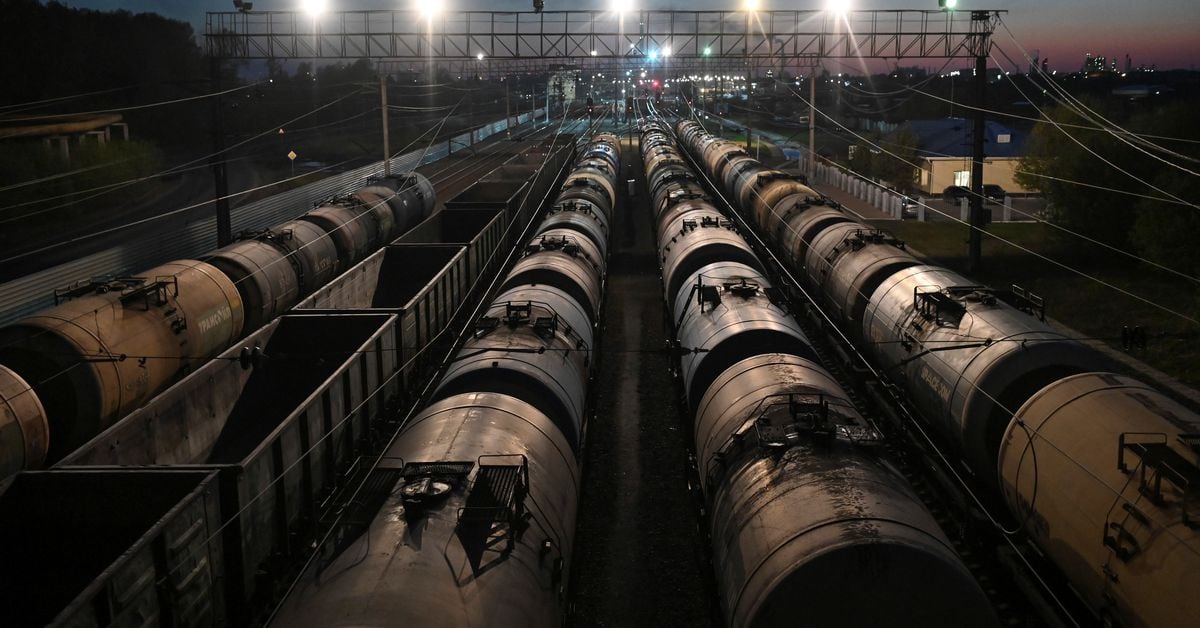

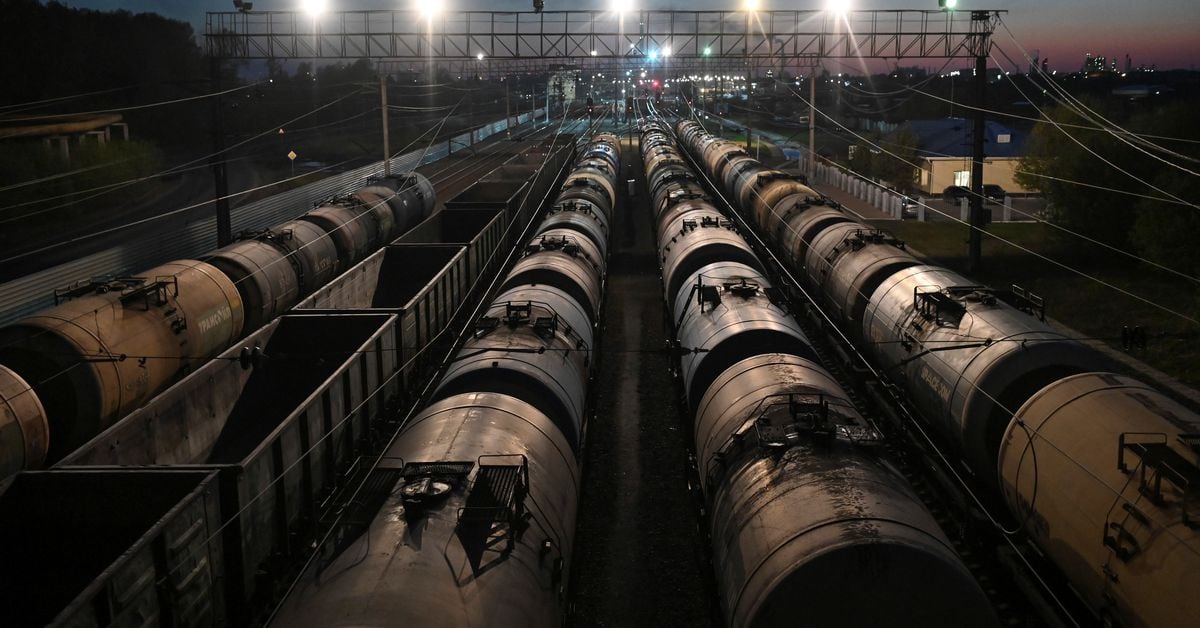

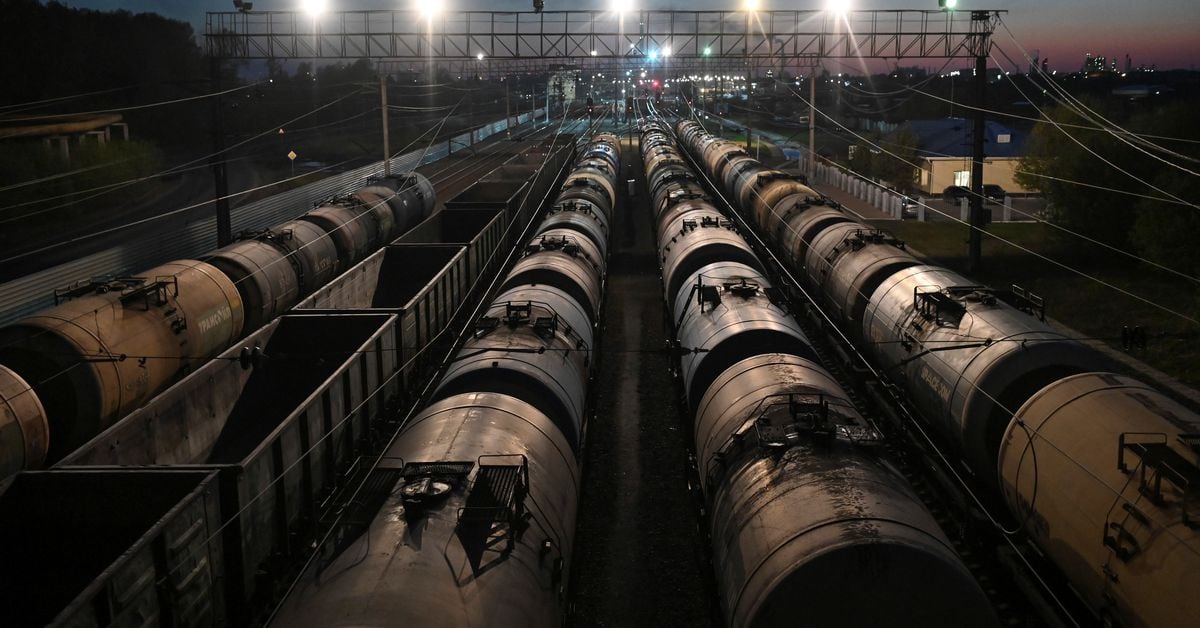

Reuters has been known to pump fake news before, but some of the movement in oil stocks today confirms the article may be correct that the US is headed towards leaving russian oil or possibly leading the charge for oil based sanctions. Time will tell. I am looking for some continuation plays in some cheap low float energy stocks. ENSV, NINE, and IMPP.

I can say one thing about NINE. They have a yard in my hometown. I drove by there today, and their yard was completely empty of service trucks. May not mean a whole hell of a lot, but it does mean they're busy.

www.reuters.com

www.reuters.com

I can say one thing about NINE. They have a yard in my hometown. I drove by there today, and their yard was completely empty of service trucks. May not mean a whole hell of a lot, but it does mean they're busy.

U.S. may act alone to ban Russian oil imports, sources say

The United States is willing to move ahead with a ban on Russian oil imports without the participation of allies in Europe, two people familiar with the matter told Reuters, in light of Russia's invasion of Ukraine.

Its being reported that Biden will forge ahead and ban Russian Oil without the consent of our allies.Reuters has been known to pump fake news before, but some of the movement in oil stocks today confirms the article may be correct that the US is headed towards leaving russian oil or possibly leading the charge for oil based sanctions. Time will tell. I am looking for some continuation plays in some cheap low float energy stocks. ENSV, NINE, and IMPP.

I can say one thing about NINE. They have a yard in my hometown. I drove by there today, and their yard was completely empty of service trucks. May not mean a whole hell of a lot, but it does mean they're busy.

U.S. may act alone to ban Russian oil imports, sources say

The United States is willing to move ahead with a ban on Russian oil imports without the participation of allies in Europe, two people familiar with the matter told Reuters, in light of Russia's invasion of Ukraine.www.reuters.com

Investing is a funny beast. I say this because its one of the few things in life that doesn't have a singular way to win (or lose). While we aren't in uncharted waters we are in waters none of us have probably seen before as investors. Even with WW2, at its worst (1937 - 1942) the market dropped 60%. It didn't kill it though. As long as there are people and currency of some form there will be a market. And if nukes fly then, well, it doesnt really matter much does it?

There is so much chop and noise right now, unless you are day trading it, you need to put your focus on a 2-3+ year timeline. I honestly think we see a continuation this same sort of uncertainty and chop until the Nov midterms. And with inflation at its current levels just sitting on cash until things stabilize is actually worse than equities. You have to look forward. Who do you want to own in 2 or 3 years? Those are the decisions you should be looking at. If the last couple of years havent shown you yet, there are probably 20 or 30 companies that stand above it all. They check every single box (unassailable moat, iron fortress balance sheet, dominate their industry, little or no debt, huge piles of cash and positive cash flows etc) that help them come out on the other side. We discussed all of this ad nauseum in this thread almost 2 years ago to the day when Coronachan hit. Go back and read those posts.

We are facing a macro condition involving one of the largest nuclear powers in the world and a couple of hundred thousand troops fighting near Europe and AAPL is down to where it was in November. Just three months ago. This isnt a pump AAPL post, but more to reflect that some companies are bellwethers and if you are asking where your money should go, try looking at the foundational companies. Indexes and High quality should be your targets of opportunity right now.

tldr: Don't panic, look beyond the chop, buy quality, hope we dont get nuked.

There is so much chop and noise right now, unless you are day trading it, you need to put your focus on a 2-3+ year timeline. I honestly think we see a continuation this same sort of uncertainty and chop until the Nov midterms. And with inflation at its current levels just sitting on cash until things stabilize is actually worse than equities. You have to look forward. Who do you want to own in 2 or 3 years? Those are the decisions you should be looking at. If the last couple of years havent shown you yet, there are probably 20 or 30 companies that stand above it all. They check every single box (unassailable moat, iron fortress balance sheet, dominate their industry, little or no debt, huge piles of cash and positive cash flows etc) that help them come out on the other side. We discussed all of this ad nauseum in this thread almost 2 years ago to the day when Coronachan hit. Go back and read those posts.

We are facing a macro condition involving one of the largest nuclear powers in the world and a couple of hundred thousand troops fighting near Europe and AAPL is down to where it was in November. Just three months ago. This isnt a pump AAPL post, but more to reflect that some companies are bellwethers and if you are asking where your money should go, try looking at the foundational companies. Indexes and High quality should be your targets of opportunity right now.

tldr: Don't panic, look beyond the chop, buy quality, hope we dont get nuked.

- 1

I picked a really shitty day to be on the road visiting a new acquisition

Markets gonna be fun around 10:45

Markets gonna be fun around 10:45

Falstaff

Bronze Baronet of the Realm

- 8,785

- 4,029

A tale as old as time.Its being reported that Biden will forge ahead and ban Russian Oil without the consent of our allies.

- 1

- 1

- 1

- 10,798

- 19,250

Energy ETF up 22% since late January, mostly oil support and large oil companies.

Missed that boat.

Borzak

<Bronze Donator>

- 27,938

- 37,758

Missed that boat.

Bought then but I'm cautious and once it got to 10% started taking some pofits.

Strifen

Molten Core Raider

- 312

- 1,590

The world is headed for commodities scarcity for many years to come. Mostly in energy and rare earths/battery metals. Mentioned this before but there’s a huge rotation on going out of high growth tech and into commodities this year. Countries are going to struggle just to keep the lights on.

Energy ETF up 22% since late January, mostly oil support and large oil companies.

I'm up 28% in my VDE... unfortunately it's only 5% of my portfolio.

Share: