My city gets a huge chunk of its revenue from property taxes, most of which are primary living properties. How would you want them to replace those funds?

Reduce spending.

- 3

My city gets a huge chunk of its revenue from property taxes, most of which are primary living properties. How would you want them to replace those funds?

My bodies ready for the real estate market to bottom out. I have the equity to take on my final form, a....housing is in such a decline that this holds true

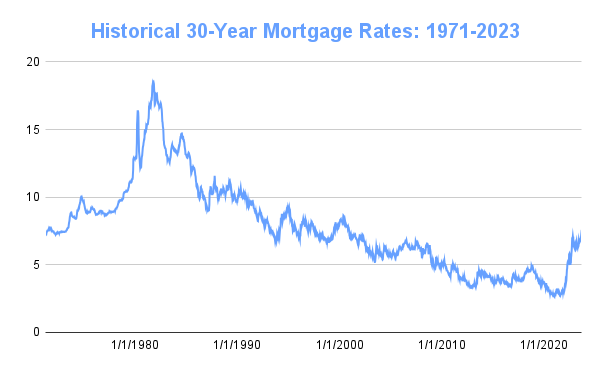

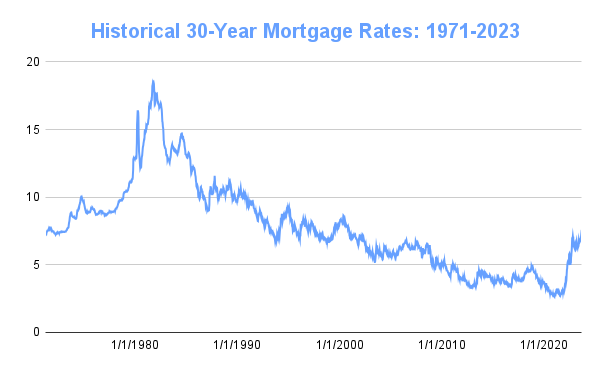

'It's still a seller's market' despite mortgage rates hitting 23-year high

At 7.3% the week ending Sept. 28, the 30-year fixed-rate mortgage hit the highest level since 2000. Still, home prices are rising.www.usatoday.com

these kids need fucking pictures to understand, thanks bidenn

yea i remember when i got this house i told my mom i got a mortgage instead of paying cash and she was like why, it's so expensive. and i told her mom it's only like 2.4% (i told her in a different way in chinese, i didn't know how to say percentage, but said 2cents of a dollar, the point got across) and shes like not 20percent? she said our ny house was 12% in the 80sI think people miss the point the goddamn internet rates never should have been so low in the first fucking place, followed by goblin money printing never should have been allowed either.

12% on something that costs 3-4x annual salary is still more affordable than right now.yea i remember when i got this house i told my mom i got a mortgage instead of paying cash and she was like why, it's so expensive. and i told her mom it's only like 2.4% (i told her in a different way in chinese, i didn't know how to say percentage, but said 2cents of a dollar, the point got across) and shes like not 20percent? she said our ny house was 12% in the 80s

it's not like our parents generation "had it easy"

The only people that are hoping the housing market bombs are the people that can’t afford a house.Ive said it before and I’ll say it again. Interest rates need to go back to those 1980’s interest rates and STAY there. Yea, yea. This is horrible in the short term. People wont be buying houses, much less will it cause the recession that we’re in to actually show its multiple heads to people.

People need to understand that if its 20% interest to buy a house - then a 250k dollar house over 30 years is something like 4200 hundred a month. The vast majority if the nation cannot afford that. Whats the average income, what, 58,000 a year? Even with double income, thats one hell of a payment for most people.

Under that premise - the market is going to bomb in value. Thats generally what most people are hoping for. 90,000 at 20% for 30 years is 1500 a month and thats way more palatable.

As long as the Biden Administration is pussy footing around with the IRS - we’re going to continue to be stuck in this situation.

Theyre already doing that, so I dont necessarily see the difference in what you're saying or why you mention it. But just because it was mentioned, when property values fall based on interest rates - companies like American Towers for example, will no longer have a desire to own them based on the fact that their liquid cash would be better off invested in something with a higher return.I think that thesis is kind of misplaced.

You can crank interest rates to 50% but it doesnt take current wealth out of the system. You just cripple those who rely on debt. You start making average family houses $90k, then they will just be snapped up instantly by the deep pocketed institutions that are flush with real wealth and you will truly live life as renters forever.

There are exceedingly more and more people that cannot afford a house. You should be able to see that there would be a large benefit to the nation at large, including yourself, if more people can afford a house. Being narrow minded about it all is pretty Foler'esque.The only people that are hoping the housing market bombs are the people that can’t afford a house.

We dont have new housing being built because across the board, you have neighborhood, county, and state regulations that are keeping what should be an affordable build out of reach for the average American. Most of which are are disguised as ecological regulations - when in reality, its just a barrier to entry into a neighborhood. As for the lack of housing, Canada is a prime example of why housing is getting tighter. You quote a lack of 7 million houses, and I quote an influx of almost 12 million immigrants this year alone, and the year is not over yet.Yeah, let's blow up a quarter of our national wealth. What could go wrong? I understand that there is a problem with housing affordability (I just bought one myself earlier this year and it hurt), but completely ass-fucking everyone who currently owns real estate is not the answer.

View attachment 493903

Fixing affordability will only come with a combination of changes: Preferences evolving to accept smaller, denser living spaces (apartments), accompanying changes of zoning that will allow the conversion of larger residences into smaller and denser, remote work allowing masses of people becoming willing to live out in the boonies (moving backwards on this right now), and employment growth in construction and trades that will facilitate and lower the cost of building.

Until these things happen, not a lot is going to change. We're short almost 7 million homes for the current population and there isn't anywhere to put them (where anyone actually wants to live) or tradesmen to build them.

I quote an influx of almost 12 million immigrants this year alone, and the year is not over yet.

obviously supporting things that dont consolidate the population into high population areas would be beneficial all around.

That's a nice chart method.. I think I'll steal it.Yeah, let's blow up a quarter of our national wealth. What could go wrong? I understand that there is a problem with housing affordability (I just bought one myself earlier this year and it hurt), but completely ass-fucking everyone who currently owns real estate is not the answer.

View attachment 493903

Fixing affordability will only come with a combination of changes: Preferences evolving to accept smaller, denser living spaces (apartments), accompanying changes of zoning that will allow the conversion of larger residences into smaller and denser, remote work allowing masses of people becoming willing to live out in the boonies (moving backwards on this right now), and employment growth in construction and trades that will facilitate and lower the cost of building.

Until these things happen, not a lot is going to change. We're short almost 7 million homes for the current population and there isn't anywhere to put them (where anyone actually wants to live) or tradesmen to build them.

The fuck you say, i hope to god it crashes and the near 100k I’m sitting on is enough to buy another house cash money. The housing market will recover, the people wanting the crash are the people with money and know it will recover.The only people that are hoping the housing market bombs are the people that can’t afford a house.