Rabkorik

Silver Knight of the Realm

- 168

- 47

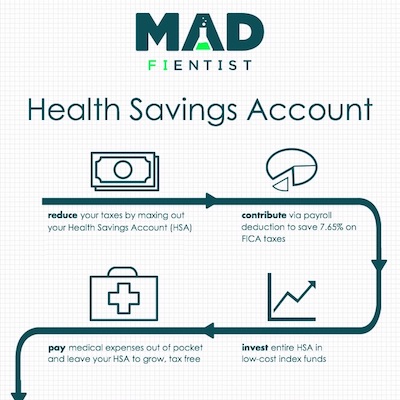

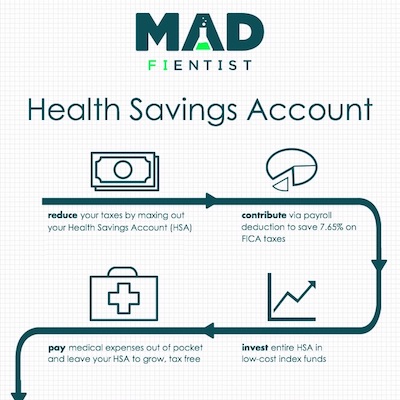

I would agree with Blazin on the HSA part being the only consideration but I think I'm on the other side. It can potentially be a very powerful investing tool. I end up maxing mine every year and just keep enough in the non-invested side to cover the deductible if ever necessary.

For reference:

www.madfientist.com

www.madfientist.com

For reference:

HSA - The Ultimate Retirement Account

A Health Savings Account (HSA) is the ultimate retirement account because it can provide completely tax-free savings for early retirement!

- 1

- 1