Investing General Discussion

- Thread starter Furious

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Ride or die forever.So I've mentioned before I fucked up with PLTR and ended up buying near the ATH. I've managed to dollar cost down to $26.01. Should I just get out of it now and wait for it to inevitably fall back down towards $20-22?

Or just get out now and get out forever?

- 2

I am a PLTR bull. If you have gotten your basis down to the mid-20's I would hold. Just keep selling crazy out of the money covered calls when it hits the top of its trough (like now) and buy to close when it hits the bottom of the trough near $22. It basically prints money this way. I personally sell the $35 strike calls. If by some odd chance i get assigned, well I am not complaining with that profit.So I've mentioned before I fucked up with PLTR and ended up buying near the ATH. I've managed to dollar cost down to $26.01. Should I just get out of it now and wait for it to inevitably fall back down towards $20-22?

Or just get out now and get out forever?

- 2

Fogel

Mr. Poopybutthole

Here are the results from todays Lotto Fridays I mentioned earlier. I still haven't played these (And can't right now since fidelity doesn't let you open options on day of expiry), but it could be fun if you're feeling like having a casino experience with a few hundred

and the Mouse still isnt paying a dividend. Wait until they crank that bitch back up.Nice little DIS pop. I had bought more last week at the 200D support. $175.21 cost basis.

Gravel

Mr. Poopybutthole

Yeah, I've done pretty well at timing the last two tops (assuming today was a top, I was super close to the high today), and bought back in around $22 last time it was there. Sold about 2/3 of what I had today, probably should've sold it all.I am a PLTR bull. If you have gotten your basis down to the mid-20's I would hold. Just keep selling crazy out of the money covered calls when it hits the top of its trough (like now) and buy to close when it hits the bottom of the trough near $22. It basically prints money this way. I personally sell the $35 strike calls. If by some odd chance i get assigned, well I am not complaining with that profit.

I'm tempted to put this play money into something else, but PLTR does seem to consistently have 3-5% days I could play with.

- 1

Fogel

Mr. Poopybutthole

Whats your goal with this play money? Just looking for short term swing trades? You could check out the bitcoin related stocks as they have pretty good swings and follow BTC so you can use that as an indicator. Check out MARA, RIOT, CLSK, BTBT.Yeah, I've done pretty well at timing the last two tops (assuming today was a top, I was super close to the high today), and bought back in around $22 last time it was there. Sold about 2/3 of what I had today, probably should've sold it all.

I'm tempted to put this play money into something else, but PLTR does seem to consistently have 3-5% days I could play with.

Gravel

Mr. Poopybutthole

Sadly, to make back the 50% I lost on AMC and just get out of short term trades altogether.Whats your goal with this play money? Just looking for short term swing trades? You could check out the bitcoin related stocks as they have pretty good swings and follow BTC so you can use that as an indicator. Check out MARA, RIOT, CLSK, BTBT.

Don't need the money, it's just the principle.

Unfortunately I took my 50% loss from AMC and bought PLTR close to a top. Been slowly getting back to even with it, but I've still got the 100% to go to get back to even overall.

Shonuff

Mr. Poopybutthole

- 5,538

- 792

Every trade is different...revenge trading is a sure way to lose money. Trust me, I used to be the worst revenge trader out there.Sadly, to make back the 50% I lost on AMC and just get out of short term trades altogether.

Don't need the money, it's just the principle.

Unfortunately I took my 50% loss from AMC and bought PLTR close to a top. Been slowly getting back to even with it, but I've still got the 100% to go to get back to even overall.

- 1

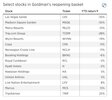

I'm aggravated that I didn't buy this whole list after I posted it here. Some of these are up 15% this week. I bought maybe 1/3 of the list.

I jumped on wynn msge and ma

wynn 10%, msge almost 30 and just about even on ma. almost want to just get out of msge and be happy with the 30.

Shonuff

Mr. Poopybutthole

- 5,538

- 792

5 day performance of the recovery list I gave you guys last week:

LVS 14%

MGSE 22

MLCO 17

TCOM 8

WYNN 12

CPA 5

NCLH 9

BKNG 11

RCL 5

H 6

HA 10

UAL 7

LYV 7

MCS 4

TRIP 10

I'm not counting MA because that's a long term hold for me. These are trades. Of the list, some of these have run so hard that they may not go much further, like LYV.

Which of these do you think will give the most alpha going forward? Trying to get a gameplan going for next week.

LVS 14%

MGSE 22

MLCO 17

TCOM 8

WYNN 12

CPA 5

NCLH 9

BKNG 11

RCL 5

H 6

HA 10

UAL 7

LYV 7

MCS 4

TRIP 10

I'm not counting MA because that's a long term hold for me. These are trades. Of the list, some of these have run so hard that they may not go much further, like LYV.

Which of these do you think will give the most alpha going forward? Trying to get a gameplan going for next week.

Last edited:

- 1

- 49,500

- 108,976

Shonuff

Mr. Poopybutthole

- 5,538

- 792

Congrats on MSGE...I'm thinking that might be one I buy more of next week. It probably got hit more because of people being worried about a shutdown in NYC, but that doesn't look like its going to happen.I jumped on wynn msge and ma

wynn 10%, msge almost 30 and just about even on ma. almost want to just get out of msge and be happy with the 30.

Look at the 1 year chart on MSGE and ponder where it can go from here.

Gravel

Mr. Poopybutthole

Revenge trading?Every trade is different...revenge trading is a sure way to lose money. Trust me, I used to be the worst revenge trader out there.

I honestly don't care that much.

It's 0.09% of our net worth. Or really, 0.046% that I lost and want to recover.

Like I said, the money doesn't matter, just the principle. Our net worth fluctuates by about 10-20x the amount we lost every day.

Shonuff

Mr. Poopybutthole

- 5,538

- 792

What you just said is the definition of revenge trading. When it's a "matter of principle" you are ascribing things to the stock that don't exist. Did AMC somehow wrong you, that you need to get money back on another stock, to restore your "honor?".Revenge trading?

I honestly don't care that much.

It's 0.09% of our net worth. Or really, 0.046% that I lost and want to recover.

Like I said, the money doesn't matter, just the principle. Our net worth fluctuates by about 10-20x the amount we lost every day.

You can tell, I'm reading a lot of books on trading psychology right now. These are things they tell you to not do.

- 1

Shonuff

Mr. Poopybutthole

- 5,538

- 792

Wow, Cramer bought more Mastercard today for actionalerts

"We are making our next buy in Mastercard and continuing our gradual scaling into this position. Shares of this global card network company have pulled back roughly 10% from recent highs, and we find this pullback to be attractive and representing a great long-term buying opportunity.

On a higher level, Mastercard benefits from the ongoing shift away from cash transactions and towards card-based and electronic payments. This a secular trend that was accelerated by the pandemic as consumers spent more time shopping online and using card and electronic payments when in stores to limit contact.

But as much as we love a secular growth story, certain characteristics about Mastercard make this a reopening play too. Mastercard's earnings power has not been able to reach its full potential in the pandemic due to international travel restrictions, which have limited cross-border volume. But those restrictions won't last forever. Once travel restrictions are removed and activity normalizes, we expect Mastercard's earnings power will increase mightily because cross-border activity is a high-margin revenue stream.

We also believe Mastercard makes for a great investment because the company is a very strong generator of cash. Mastercard's ability to generate robust amounts of cash has allowed management to seek acquisitions that increase the company's overall value proposition, while at the same time pay a dividend and buy back stock. In the most recent quarter, Mastercard repurchased 4.6 million shares at a cost of $1.7 billion. As of July 26, Mastercard had $6.4 billion remaining under its current repurchase authorization."

"We are making our next buy in Mastercard and continuing our gradual scaling into this position. Shares of this global card network company have pulled back roughly 10% from recent highs, and we find this pullback to be attractive and representing a great long-term buying opportunity.

On a higher level, Mastercard benefits from the ongoing shift away from cash transactions and towards card-based and electronic payments. This a secular trend that was accelerated by the pandemic as consumers spent more time shopping online and using card and electronic payments when in stores to limit contact.

But as much as we love a secular growth story, certain characteristics about Mastercard make this a reopening play too. Mastercard's earnings power has not been able to reach its full potential in the pandemic due to international travel restrictions, which have limited cross-border volume. But those restrictions won't last forever. Once travel restrictions are removed and activity normalizes, we expect Mastercard's earnings power will increase mightily because cross-border activity is a high-margin revenue stream.

We also believe Mastercard makes for a great investment because the company is a very strong generator of cash. Mastercard's ability to generate robust amounts of cash has allowed management to seek acquisitions that increase the company's overall value proposition, while at the same time pay a dividend and buy back stock. In the most recent quarter, Mastercard repurchased 4.6 million shares at a cost of $1.7 billion. As of July 26, Mastercard had $6.4 billion remaining under its current repurchase authorization."

- 1

Share: