Investing General Discussion

- Thread starter Furious

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Craziest day I’ve seen in a while. Snagged some QQQ monthly calls this AM when I saw the vix was red. Already 4x’d. Hard not to take profits but if we are green on todays print then the only thing keeping tomorrow from soaring is potential bank catastrophe.

- 2

Trade the action that is in front of you and don't try and fight the trend (intraday or otherwise) .

View attachment 437834

Volume today implies more than short covering, at 120M on SPY so far. Similar to the 2/24/22 red to green day in volume, largest vol green day I could find at a quick a glance.

..edit Nasdaq breath is not great though. That data does look more like short covering.

- 2

- 1

Doesn't have to be an all or nothing either. Take something off the table and pay yourself, leave some to give a chance to run.

Convinced me. Sold 3/7.

Gracias amigo

- 1

At some point far in the future, when we are making new highs again, Imma gonna have to sell me a chunk of AAPL cause that shit is gonna be just a whee bit overweight in my portfolio.

- 1

JPM beats while C and WFC miss. It doesnt tell the whole story though. JPM probably has the most diverse book of business of the big banks and that helps it. While they beat estimates, the actually numbers aren't pretty. Some sectors were brutal but offset by other sectors doing well.

Is that good or bad? That looks good. It means excluding auto sales, retail sales were actually higher than expected?

Just means that the consumer is still hanging in there, which is bad for wanting the Fed to stop but good that economy isn't falling off a cliff.Is that good or bad? That looks good. It means excluding auto sales, retail sales were actually higher than expected?

Primary issue hasn't changed, we have not had enough time to determine the effectiveness of the hikes that have already come. It's a lot like trying to operate a vehicle with a time delay . These numbers may already weaken significantly with the policy changes already in place OR they might not. That's why the Fed is screwed, the bar for fucking it up yet again is very low. They probably should keep hiking but much smaller amounts so that when the signs show themselves to pump the breaks they aren't going too fast to slow down tightening quickly enough and end up having to cut.

My faith in their ability to navigate this is about zero.

- 2

- 2

They probably should keep hiking but much smaller amounts so that when the signs show themselves to pump the breaks they aren't going too fast to slow down tightening quickly enough and end up having to cut.

This seems like such an obvious thing to do. It’s crazy they went so long before doing ANYTHING then it’s just well we have to do jumbo hikes every single time now.

So much middle ground ignored.

Aldarion

Egg Nazi

- 11,431

- 31,353

I don't know the politics of the Fed, but until early summer or so, it was firm leftist political dogma that there was no inflation. Zero. I got in so much trouble with them any time I'd mention it. In the political bullshit world they were still saying that price increases werent inflation, they were just "supply chain issues".

If any of that attitude crept into the Fed it could certainly have contributed to delaying action.

If any of that attitude crept into the Fed it could certainly have contributed to delaying action.

Gravel

Mr. Poopybutthole

Yep. It was just covid recovery and supply chain issues. Then the inflation was transitory for a year.I don't know the politics of the Fed, but until early summer or so, it was firm leftist political dogma that there was no inflation. Zero. I got in so much trouble with them any time I'd mention it. In the political bullshit world they were still saying that price increases werent inflation, they were just "supply chain issues".

If any of that attitude crept into the Fed it could certainly have contributed to delaying action.

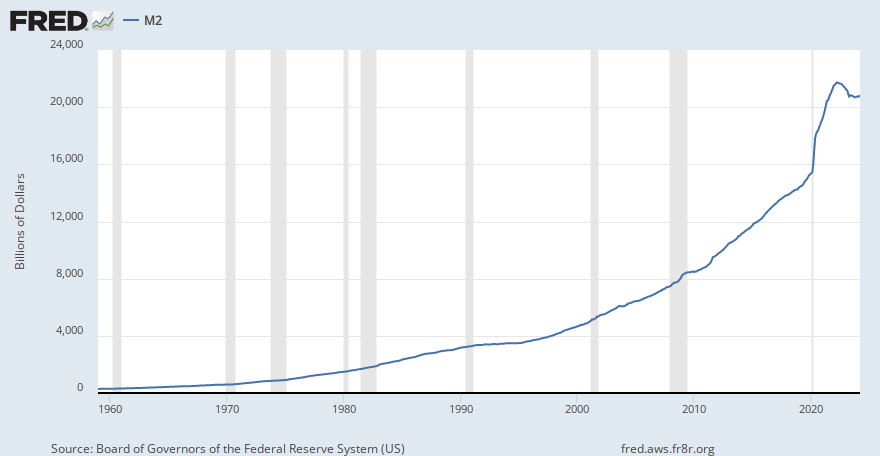

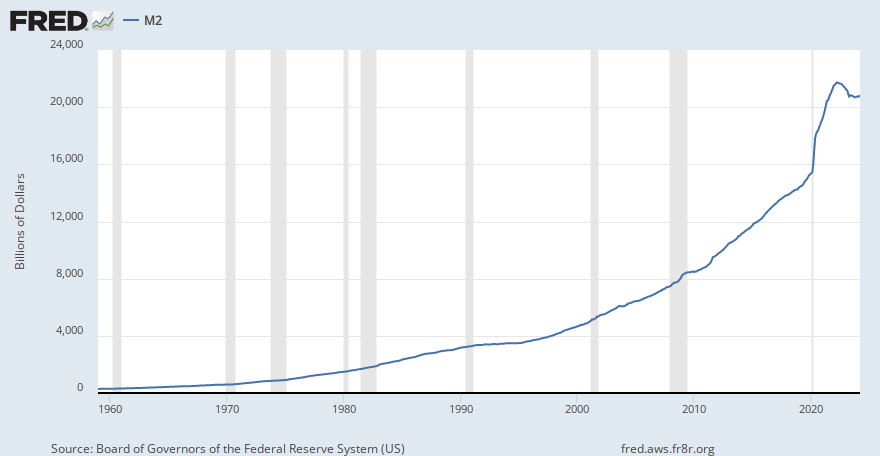

Meanwhile we all knew that was bullshit. We all saw how much money we printed and how large QE had gotten.

Yep. It was just covid recovery and supply chain issues. Then the inflation was transitory for a year.

Meanwhile we all knew that was bullshit. We all saw how much money we printed and how large QE had gotten.

M2

View data of a measure of the U.S. money supply that includes all components of M1 plus several less-liquid assets.

fred.stlouisfed.org

Yes, but since February it's been flatter than it has been since Greenspan.

We could make a separate thread on the FED and it would run forever.I don't know the politics of the Fed, but until early summer or so, it was firm leftist political dogma that there was no inflation. Zero. I got in so much trouble with them any time I'd mention it. In the political bullshit world they were still saying that price increases werent inflation, they were just "supply chain issues".

If any of that attitude crept into the Fed it could certainly have contributed to delaying action.

- 1

40 year high inflation has that effect.

M2

View data of a measure of the U.S. money supply that includes all components of M1 plus several less-liquid assets.fred.stlouisfed.org

Yes, but since February it's been flatter than it has been since Greenspan.

View attachment 438009

The problem is they need to thread an impossible needle. How do you weaken the job market enough that wage growth stalls but not so much that it crashes. All with data that is on a years long lag. Or tighten enough that you kill the meme non viable debt zombie companies but not so much that you kill viable businesses.Just means that the consumer is still hanging in there, which is bad for wanting the Fed to stop but good that economy isn't falling off a cliff.

Primary issue hasn't changed, we have not had enough time to determine the effectiveness of the hikes that have already come. It's a lot like trying to operate a vehicle with a time delay . These numbers may already weaken significantly with the policy changes already in place OR they might not. That's why the Fed is screwed, the bar for fucking it up yet again is very low. They probably should keep hiking but much smaller amounts so that when the signs show themselves to pump the breaks they aren't going too fast to slow down tightening quickly enough and end up having to cut.

My faith in their ability to navigate this is about zero.

there is no soft landing. It was always a false option.

the reality is they need prolonged pain and then political solutions to bring inflation down because a huge part of the problem is policy, policy has been a huge driver in labor participation falling and that is a primary driver of inflation the fed can do nothing about

- 1

Share: